Surviving the Brutal Crypto Market with Michael Peres

In this interview with Michael Peres (also known as Mikey Peres), we unpack his playbook for survival in the brutal crypto market.

Nov. 17 2025, Published 3:55 p.m. ET

The market can stay irrational longer than you can stay solvent, and this cycle is intent on proving it. Bitcoin is pressing into its 50-week SMA, the last high ground between a wounded bull and a hungry bear. The elusive euphoric alt season hasn’t arrived to comfort the cliff dwellers; instead, confusion and despair are taking over as two narratives brawl in real time: “the bull run is already over” versus “it hasn’t even truly started.”

If you’re in the market, it’s eating you from the inside: chasing tops, puking bottoms, second-guessing every tick. Ruthless market makers are hunting the over-leveraged, engineering liquidity runs and an endless, weaponized stream of liquidations. In the wake of the biggest liquidation event in crypto history, the final twist of the knife, the lesson is simple: survive the cycle, don’t predict it.

In this interview with Michael Peres (also known as Mikey Peres), we unpack his playbook for survival: how to avoid becoming exit liquidity and how to stay solvent long enough to be present for the move that matters. It starts with the foundation most neglect until the market painfully reminds them: clear rules, firm protocols, and a strategy that serves as your compass in the wild west of crypto.

Peres approaches the market with an engineer’s discipline. With degrees in computer science and mathematics and more than fifteen years working in software and cloud infrastructure, Peres approaches the market with an engineer’s discipline. He is the founder of Block Editorial and host of The Michael Peres Podcast, where he interviews industry leaders in tech, Web3, crypto, DeFi, and traditional finance, while a parallel focus on longevity and aging science through Project LongevityOne keeps him thinking in long time horizons.

The thread running through it all is a systems mindset: he sees Bitcoin and crypto as noisy, sentiment-driven environments where the real edge is careful homework, prudent positioning, and patience, with the aim of staying solvent across the cycle rather than trying to call every move.

Pumps Are for Sellers, Not Buyers

According to Peres, by the time news of a pump or narrative hits X and YouTube, the low-risk, high-upside window is usually gone. Buy the headline, and you’re volunteering as exit liquidity for smart money, the ones who positioned days or weeks before and are now happy to sell into your enthusiasm. The first pullback comes, your “conviction” vanishes, and you’re left holding a story you never really understood.

“My rule is simple,” Peres says. “If an investment looks appealing, I give myself a minimum of two weeks before I’m allowed to take a real position. I never ape or FOMO in. I’ll buy $1 to pin it to my dashboard, study the fundamentals and the chart, and ask if it’s something I can genuinely hold long-term. Only then, when fear hits and sentiment flips, I look for a healthy position. I want the market to come to me, not the other way around.”

For Peres, the antidote to chasing is conviction. Learn the basics and the vocabulary. Absorb information from others, but use it to refine your own base, not replace it. When you understand what you own and why, dips look like a sale, not a reason to panic. Process information properly. Following crowd calls keeps you a few steps behind the winners, and without a real thesis you won’t hold through the bad days to be present for the good ones.

Peres puts it bluntly: "If your mom texts you to buy Bitcoin, it is probably time to sell. If you see people lining up to buy gold at all time highs, you are watching exit liquidity form in real time.”

Then he brings it back to conviction. "If you have done your homework and you have conviction in what you are buying, why would you want it less when it is on sale?" Peres says. "It makes no sense. If you spent weeks vetting a house at 1,000,000 dollars, looking at the location, build, and inspections, and nothing changes except the seller drops to 800,000 dollars, you do not walk away, you lean in. The price got better, the thesis did not get worse."

Chasing is emotion. Survival is a process. Do your due diligence and plan for every outcome. He is not trying to catch every move; he is trying to stay alive for the ones that matter.

The Ruthless Liquidity Hunt

Retail traders, people like you and me, can click "market buy" without thinking about liquidity. For whales and market makers, there often are not enough sellers to fill their orders at the prices they want, so that liquidity is manufactured where retail is most exposed. As Peres puts it, big players build positions where your stops are. Obvious levels, prior highs and lows, round numbers, and especially crowded funding and open interest zones become hunting grounds.

“Market makers often hunt the exact areas where it would be ‘textbook smart’ to place a stop loss, right below support or right above resistance.” Price can be pushed into those pockets, cascades trigger, forced sellers provide the flow, and while everyone else is puking, the whales are quietly filling.

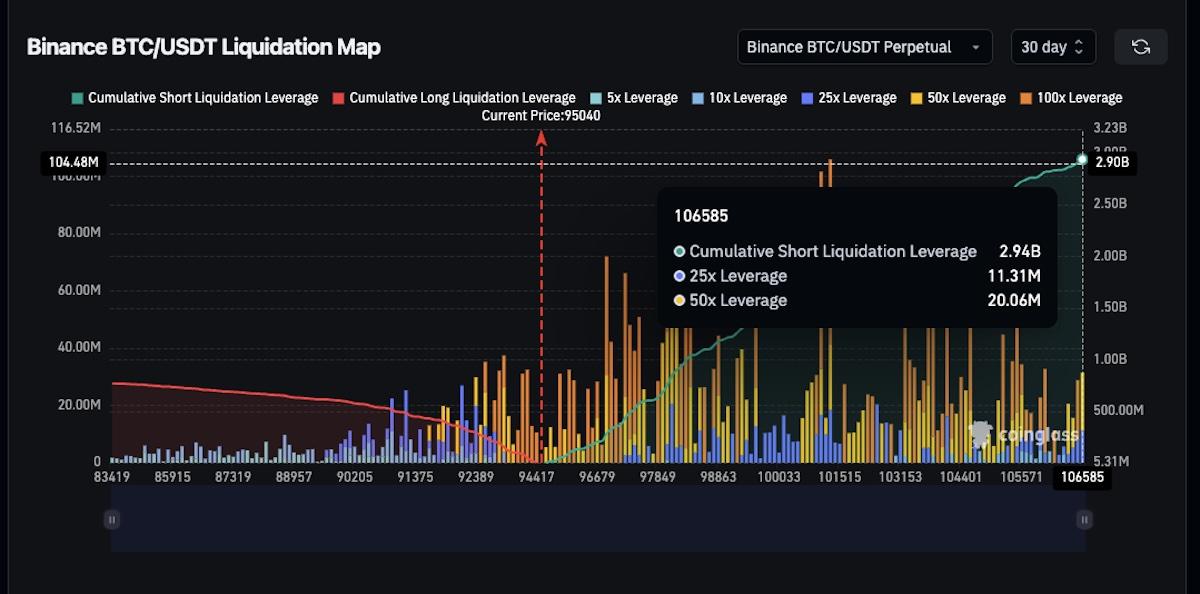

Binance BTC/USDT liquidation map below shows billions in stacked leverage; when price is driven into these clusters, cascading liquidations create the liquidity whales use to enter and exit positions.

Binance BTC/USDT liquidation map, 30 day.

“The 100K BTC milestone was a true crossing of the Rubicon,” says Peres. “The Overton window shifted from ‘is BTC a highly speculative asset that can potentially crash to zero’ to ‘this asset class presents serious promise for the future’ and the roster changed with it, from retail to heavy hitters and institutions.”

Leverage has always been hunted, but with that shift the hunting feels more relentless than ever. No matter which direction Bitcoin moves, it often whips hard the other way first, clearing out overleveraged 50x and 100x traders before resuming the trend.

Everyone already knows Bitcoin is volatile; what matters for survival is understanding how deliberately that volatility is weaponized. Leverage has become bait, and the swings are the hunt. If you’re trying to survive the cycle, avoid high-risk leverage trading. Play it smart and safe, and unless you’re highly experienced and operating with a strict risk plan, try to avoid trading with borrowed money.

"I use the BTC liquidation map as a short-term north star. If I see leverage building up in one direction, with everyone aggressively long or aggressively short, it is a strong hint about where price might go next. The market has every incentive to push price into that pain, trigger those liquidations, and use the forced buying or selling as liquidity."

Fear and Greed: If You Knew Nothing Else

“It’s not about timing the market, it’s about time in the market,” — Warren Buffett.

For Peres, surviving a crypto cycle is the same idea in a more hostile arena: you don’t win by perfectly calling tops and bottoms, you win by still having capital when the move that matters finally comes.

If you knew nothing about technical analysis, know this: most retail traders lose. Regulators and broker disclosures routinely show roughly 74–89% of retail accounts lose money on leverage; one recent regulator study found 91% of retail derivatives traders lost over a single fiscal year.

It sounds simple, but it demands brutal discipline: act against your emotions. If most people lose, the logic is clear, do the exact opposite. Take profits on green days when everyone feels euphoric, and buy when there is blood in the streets and your stomach hates the idea.

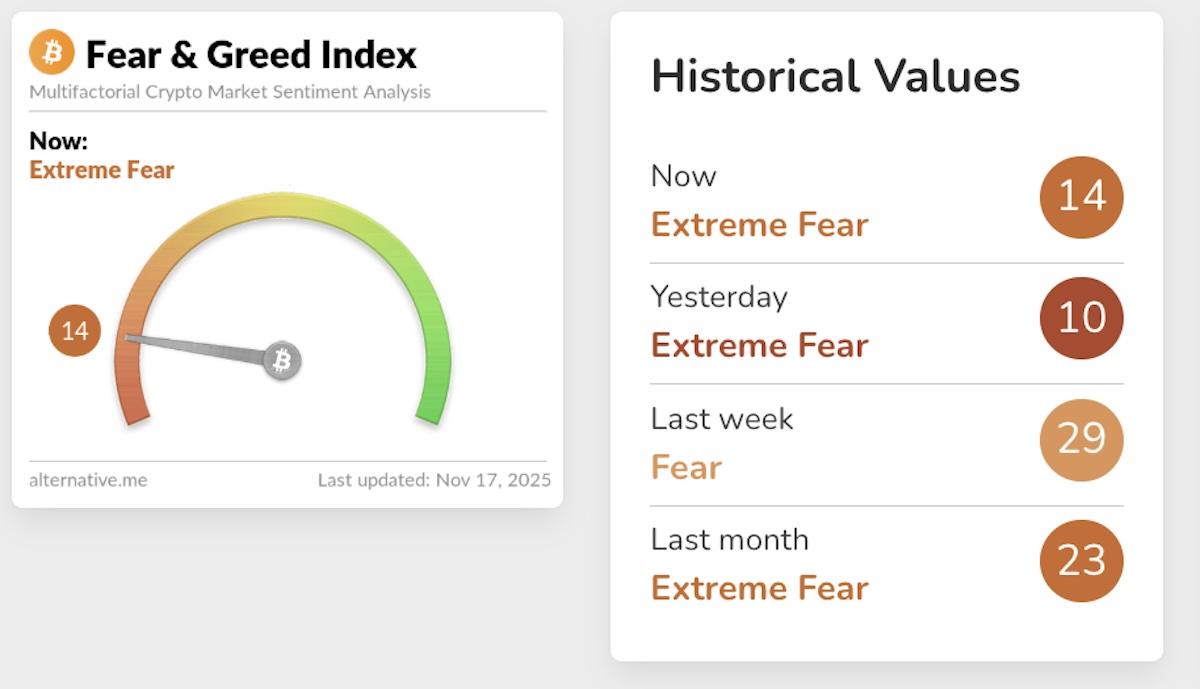

The Crypto Fear & Greed Index is a sentiment gauge that distills retail mood in the crypto market into a single score from 0 (extreme fear) to 100 (extreme greed). It blends volatility, momentum, volume, dominance, and social data to show how emotional the crowd is at any given moment.

It isn’t a trading system, just a rough contrarian compass: extreme fear has often lined up with better long-term entry zones, while extreme greed has tended to cluster around local or cycle tops.

In the graphs below, orange markers show periods when the index sat in fear to extreme fear, while green markers show greed to extreme greed. Notice how buying into fear and selling into greed would have consistently put you in a stronger position over a modest to moderate timeframe.

October 10: The Biggest Liquidation in Crypto History

On October 10, the market did not just sell off; it detonated. In under a day, roughly 20 billion dollars in leveraged positions were wiped out, the biggest liquidation event in crypto history and orders of magnitude larger than the COVID and FTX liquidations. Some altcoins collapsed as much as 92 percent in seconds as cascading stops and margin calls fed on each other. When a position is liquidated, it is gone, and for many traders, that means blown accounts and being forced out of the game, losing thousands or even millions in moments.

The spark was Trump’s surprise announcement of 100 percent tariffs on Chinese imports, which hit an already overleveraged market and triggered a cascading death spiral of forced selling that nuked momentum and reset the entire board.

Bitcoin Is Your Sanctuary

Benjamin Cowen, a respected quantitative analyst with a PhD in engineering, has amassed a significant following and has been tracking crypto cycles for years. One of his core claims, which Peres echoes, is blunt: since 2022, altcoins have consistently underperformed Bitcoin.

This is the weekly TOTAL2/BTC chart, the total altcoin market cap priced in Bitcoin, and it tells a simple story: altcoins have been bleeding to BTC since the first half of 2021. After that blow-off peak, the ratio rolled over and has spent nearly four years making lower highs and lower lows, with every altcoin “season” attempt fading back into the same downtrend.

Peres argues that an investment strategy should start with a simple mandate: minimize downside and maximize upside in a way that keeps you in the game. If low-cap altcoins carry enormous risk and still haven’t outpaced Bitcoin this cycle, then from a survival standpoint, keeping it simple and staying with BTC just makes the most sense in this current climate. Cowen made a similar argument with Ethereum.

He has long said ETH would “bleed to Bitcoin” until it hit a key bottom on his logarithmic regression band. He argued this for months, and he was spot on. Once Ethereum finally “went home,” it quickly found momentum to blast through to new all-time highs after years of disappointment and negative sentiment.

That is certainly not to say altcoins are a bad investment, and many have real-world utility, and possibly a healthy future. However, if you are new to the industry and want to position yourself on a healthy, solid foundation while you learn and grow, it makes sense to keep things simple and reduce the risks that come with holding low-cap coins over multiple cycles.

Start with Bitcoin as your core, safer position. Then, if you want to climb a bit further up the risk curve, add a modest allocation to a few high-cap altcoins with strong fundamentals and a proven track record.

“People forget,” Peres says. “An altcoin can go up in dollars and still bleed to Bitcoin if BTC is moving faster. You feel like you’re winning because your portfolio in fiat is rising, but measured against BTC you’re actually falling behind, badly underperforming what you could have earned by simply holding the safest crypto asset, Bitcoin”.

In a cycle built to hunt overexposure and bad risk, his bias is clear: treat spot Bitcoin as home base. Doing more isn’t always better; piling on needless complexity often increases your downside and waters down your upside.

The Battle for the Narrative Rages On

The war between the bulls and the bears is unrelenting, and right now the market sits at a fork between two competing narratives that both sound convincing, with the front line drawn at Bitcoin’s 50-week SMA, the ledge where the cliff dwellers are hanging on and both sides are sure the next move will prove them right.

The bulls argue:

- No classic blow-off: where was the euphoria? Coinglass tracks a curated basket of 30 different bull market peak indicators, ranging from classic on-chain signals like Pi Cycle Top, MVRV, Puell Multiple and the Bitcoin Rainbow Chart to macro and sentiment gauges that have historically nailed prior cycle tops. So far in this cycle, zero out of 30 have actually triggered a peak signal. For anyone who has watched these models call tops in 2013, 2017 and 2021, it is hard to look at a 0-of-30 reading and confidently say, “this was the final high.”

- No alt season. Simply put, most altcoins have been decimated, and many are trading lower today than they were months, even years ago. How can you seriously call it a bull run when the broader market never really rallied?

- Bitcoin is experiencing its “IPO moment.” Like many IPOs such as Robinhood or Coinbase, the big public debut often brings a sharp drawdown as early risk takers cash out and wealth shifts to new hands. In that framing, six figure Bitcoin plus spot ETFs is an IPO style wealth transfer: VCs and early whales sell into ETFs and institutions, price wobbles, but supply migrates to stickier long term holders. You can see this in recent charts showing ten year plus whales selling portions of their positions in an unprecedented way.

- Business Cycle Supercycle. We are in a supercycle, not a neat four year loop governed by Bitcoin’s halving calendar. Raoul Pal and RAN argue that Bitcoin tracks global liquidity and the business cycle much more than the halving calendar. In that framing, a liquidity driven supercycle that could easily stretch into 2026 instead of ending cleanly with a 2025 top.

- Macro is slowly shifting from headwind to tailwind. As quantitative tightening winds down and rate cuts and refinancing pressure force more liquidity back into the system, BTC feeds off liquidity, and turning the money printers on can set alt season into full gear.

- The four year halving script should naturally weaken. With roughly 93 to 94 percent of Bitcoin already mined and issuance now under 1 percent per year, each halving changes supply less than it used to, which simply diminishes the influence new coins have on the overall market.

The bears counter with:

- “This time is different”, a lesson never learned. Benjamin Cowen has been explicit: major BTC peaks have historically arrived in the fourth quarter after the halving (2013, 2017, 2021), and he now expects a late-2025 peak followed by a 2026 downturn, and so far, everything seems perfectly aligned for that narrative. From that lens, the classic four-year script is the most parsimonious explanation; Occam’s razor says you stick with it unless the data clearly proves otherwise.Every cycle, people convince themselves that this time is different, and every cycle, a lot of them learn the hard way.

- The four year cycle does not owe you an alt season. Alt seasons happen when there is abundant liquidity and retail is piling in. This cycle, retail stayed home. We got slow and healthy climbs followed by long consolidations. The timing of the cycle has still lined up with history. What changed is participation and the cycle is not obligated to deliver the kind of alt frenzy people remember from past runs.

- End of Quantitative Tightening isn’t the same as starting Quantitative Easing. Even if the Fed stops running down its balance sheet, liquidity can still feel tight. Even if the money printers get turned back on, the impact can take time to be realized. It can trickle in over months and end up as the catalyst that pulls us out of the next bear market, not the thing that magically extends this current bull cycle.

- Top like behavior is already on the tape. A record liquidation event, heavy selling from long term holders as price pushed to new highs, and a failure so far to reclaim the October peak all rhyme with late cycle action in prior runs.

- October 10’s wipeout. The biggest liquidation event in crypto’s history which shattered the market and killed any immediate shot at another leg up. Retail is scarred, confidence is fragile, and it takes time for that kind of damage to heal.

You won’t time every turn. You don’t need to. The point, Peres argues, isn’t to win the bull-versus-bear debate, it’s to survive both narratives long enough to still be standing when the move that truly matters finally comes.

“Remove emotion and stay out of the daily noise,” he says. “Take a page from the Stoics: put your energy into what you can control and let go of what you cannot. Focus on building knowledge and cash flow, and let the market do what it does.”