CRO Price Dynamics: How Cronos Is Shaping the Future of Crypto Payments

Cronos (CRO)has cemented its position as a utility token with real-world applications due to its ease of use and tangible benefits.

Feb. 12 2025, Updated 7:58 p.m. ET

Cryptocurrency is as dynamic as it is disruptive, and Cronos (CRO), the utility token of Crypto.com, stands out as a key player. It is central in payments, staking rewards, and decentralized finance (DeFi).

Considering those factors, investors and crypto enthusiasts must understand how these variables influence the CRO price.

The Basics of CRO Price

Cronos (CRO) is the native token of the Crypto.com ecosystem. It has become a linchpin of Crypto.com services, ranging from powering easy transactions to earning rewards through staking. One of the standout features is its utility. It’s used for the following:

- Payments: Crypto.com allows users to pay with CRO while enjoying cash-back benefits.

- Staking: Holders can stake CRO to earn rewards or reduce trading fees on the platform.

- Ecosystem Rewards: CRO is integral to incentives, including higher cashback rates on Crypto.com Visa cards and discounts on purchases within the platform’s NFT marketplace.

CRO has cemented its position as a utility token with real-world applications due to its ease of use and tangible benefits.

What Influences CRO Price?

A mix of internal and external factors shapes the CRO price. The following drivers impact price fluctuations:

- Adoption of Crypto.com Services: As more users adopt its offerings, which include Visa cards and its NFT marketplace, the demand for CRO will increase.

- Market Conditions: The broader cryptocurrency market impacts CRO. When Bitcoin and other major cryptocurrencies rally, CRO often follows suit due to market correlation. Conversely, bearish conditions can weigh on its value.

- Token Supply and Demand: Mechanisms like staking effectively lock up a portion of CRO supply, creating upward pressure on the token price.

By monitoring these factors, you can better understand the forces shaping CRO's value.

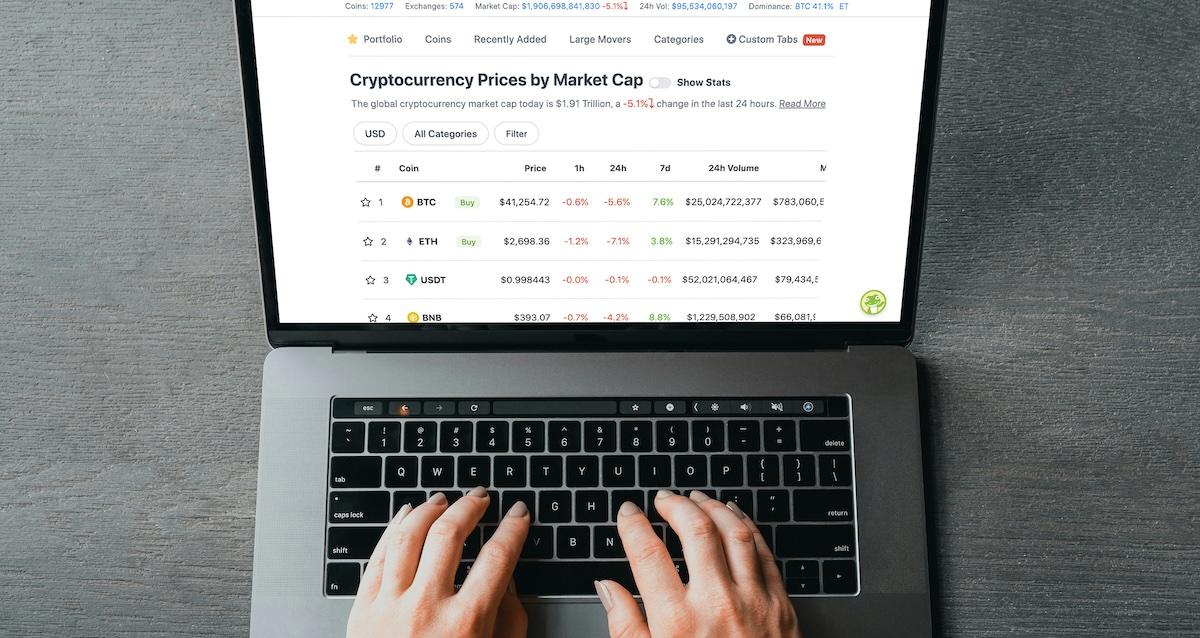

CRO Price in the Context of the Crypto Market

Another key feature is its correlation with Bitcoin and Ethereum. During marketwide surges, CRO typically benefits from increased trading activity and broader interest in currencies. However, this correlation can also expose it to downside risk during downturns.

The Future of CRO Price: Opportunities and Risks

The future of the CRO price hinges on a delicate balance of opportunities and challenges. Here are the following upsides:

Opportunities

- Global Expansion: Crypto.com's aggressive global marketing campaigns, including sponsorships like the FIFA World Cup and Formula 1, boost its brand visibility. These efforts are likely to increase CRO’s demand.

- Ecosystem Growth: The continuous evolution of the ecosystem, including its DeFi initiatives and NFT marketplace, creates additional use cases for CRO.Risks The token could experience a downward trajectory.

Here's what to look out for:

- Competition: As more platforms enter the crypto payments and DeFi space, Crypto.com must differentiate itself to maintain user interest and CRO demand.

- Regulation: Tightening global regulations around cryptocurrency could impact Crypto.com's operations and, by extension, CRO's price. For instance, restrictions on crypto advertising or staking could dampen growth.

Investors can make informed decisions about CRO by weighing opportunities against potential risks.

Advanced Strategies for Tracking CRO Price Movements

Tracking the CRO price goes beyond simple observation. Advanced tools and strategies can provide deeper insights into market trends and opportunities.

- Leverage DeFi Analytics Tools: Platforms like Bybit offer real-time data on CRO price trends to help you make informed decisions. Use these tools to monitor price fluctuations and market sentiment.

- Staking CRO for Long-Term Gains: Staking allows you to benefit from potential price appreciation. Calculate your potential returns based on staking rates and CRO’s historical performance.

- Monitor Market Signals: Watch macroeconomic indicators and Crypto.com’s announcements. Whether it’s a new partnership or regulatory news, these events can impact the CRO’s direction.