Who Owns First Citizens Bank? Bank Is Buying SVB

Who owns First Citizens Bank? The bank has agreed to purchase Silicon Valley Bank (SVB) in the wake of its collapse. Here's what we know.

March 27 2023, Published 2:50 p.m. ET

A deal could mean the crisis of banking and trust in financial systems will ease for investors and customers. First Citizens Bank has agreed to purchase Silicon Valley Bank's remaining assets. Late on March 26, 2023, the FDIC (Federal Deposit Insurance Corporation) announced the deal via press release. But who owns First Citizens Bank?

It was just over two weeks ago that SVB collapsed. California regulators took over SVB, putting the FDIC in charge. SVB's downfall triggered other bank failures including that of Signature Bank and left many concerned for the future of the U.S. banking system.

Where is First Citizens Bank based and how long has it been in business?

First Citizens Bank has a 125-year-old history, over 500 branches across 22 states, and holds over $100 billion in total assets at this time. It was founded in 1898 as the Bank of Smithfield. By 1935, it had become First-Citizens Bank and Trust, with R.P. Holding selected as president and chairman.

The company's history states that by 1974, its total assets surpassed $1 billion. In 1994, the company started opening branches outside of its home state of North Carolina. Today it's run by leadership from the third generation of the Holding family.

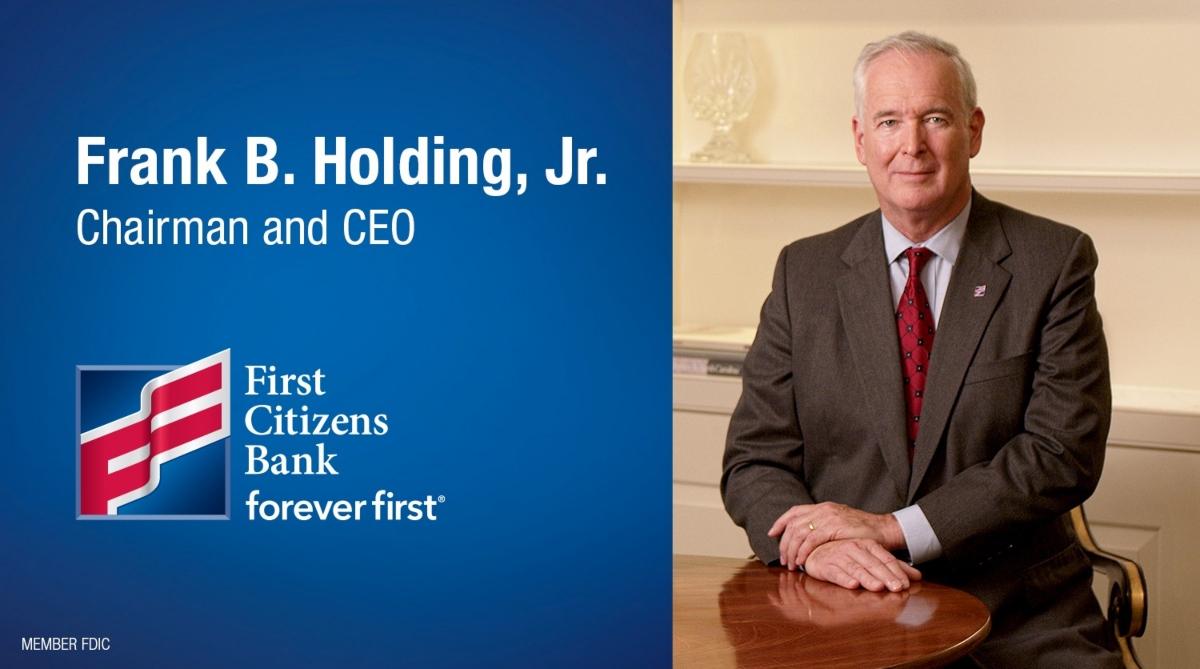

Who is the First Citizens Bank CEO?

The chairman and chief executive of First Citizens Bank is currently Frank B. Holding, Jr. He took on the role starting in 2009. His sister, Hope Holding Bryant, serves as Vice Chairwoman of the organization.

Frank B. Holding, Jr.'s net worth is unknown, though some sources estimate him to be worth about $55 million based on his share ownership in First Citizens Bank. According to Salary.com, Holding's annual salary in 2021 was $1.01 million in base salary and $4.54 million in bonuses. Over a decade at the helm of the bank has likely given him a comfortable lifestyle.

Who owns First Citizens Bank?

First Citizens Bank operates as a wholly-owned subsidiary of First Citizens BancShares, Inc. a financial holding company based in Raleigh, N.C. IronStone Bank is the other subsidiary of BancShares.

What bank merged with First Citizens Bank?

On Jan. 4, 2022, First Citizens announced the completion of its merger with CIT Group Inc. As a result of that merger, First Citizens Bank became a top-20 institution based on assets. It also secured its spot as the largest family-controlled bank in the nation.

Why is First Citizens Bank buying SVB?

First Citizens CEO Frank Holding, Jr., gave insight into how the bank has operated and possible motivation for buying Silicon Valley Bank. "We have partnered with the FDIC to successfully complete more FDIC-assisted transactions since 2009 than any other bank, and we appreciate the confidence the FDIC has placed in us once again," he stated in a company press release.

The agreement is that First Citizens is buying Silicon Valley Bank's assets, deposits, and loans in the wake of the formerly 16th-largest bank's collapse. On March 27, 2023, the 17 former branches of Silicon Valley Bridge Bank (bank branches formed during the interim since the takeover) began operating as First Citizens Bank and Trust.

Here's the value of First Citizens Bank's acquisition from SVB:

- $110 billion in SVB assets

- $56 billion in SVB deposits

- $72 billion in SVB loans

The deal states that First Citizens isn't taking on most of the $90 billion in U.S. Treasuries held by SVB at the time of the FDIC takeover, CNN Business explained. The new bank will be slightly bigger than SVB pre-collapse at $219 billion in assets.

Also included in the deal is FDIC's receipt of equity appreciation rights in First Citizens BancShares stock, worth up to $500 million. First Citizens is acquiring SVB's assets at a discount of $16.5 billion. The FDIC and First Citizens are in a loss-share transaction on commercial loans.

So far, the news has been favorable to the bank's stock. First Citizens shares (FCIZP) were up by 47 percent early on March 27, and other bank stocks started rising as well.

Is there a difference between Citizens Bank and First Citizens Bank?

Yes, these two banks are different institutions. Citizens Bank is part of Citizens Financial Group, which trades as CFG on the New York Stock Exchange.