Regulators Fine Major Banks for Using WhatsApp, Explained

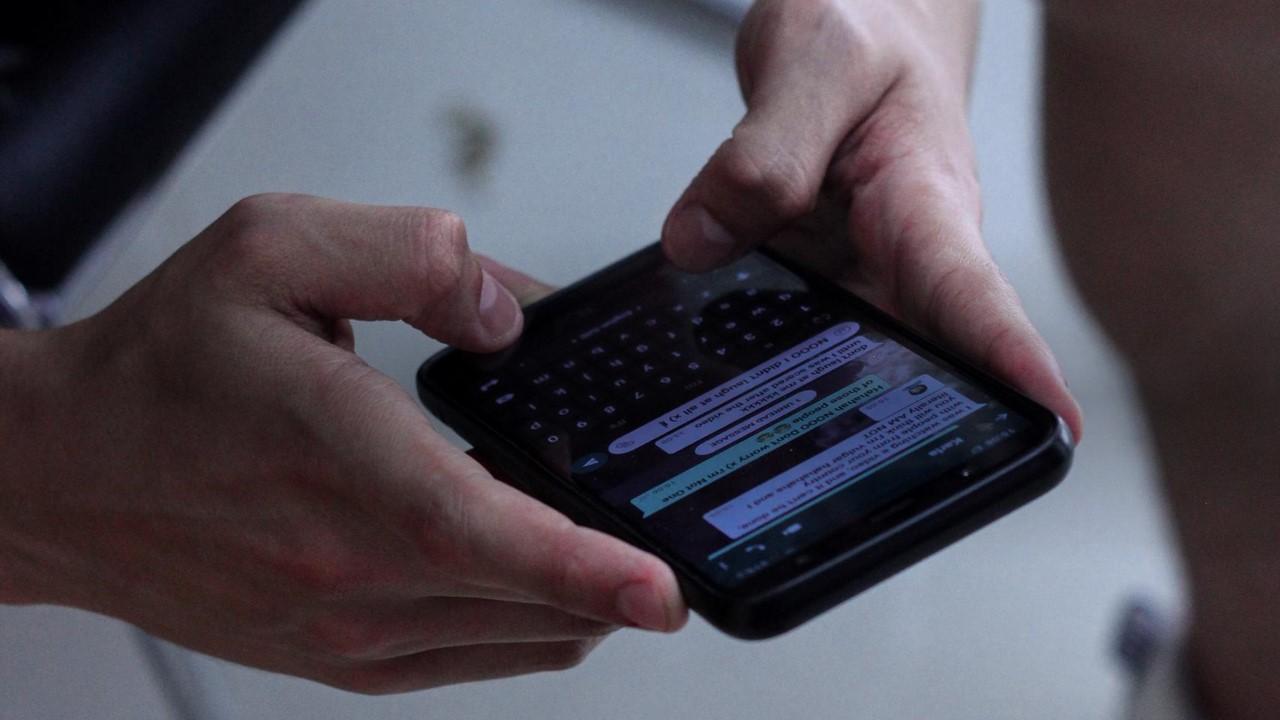

Big banks like JPMorgan and Bank of America are seeing massive fines for using the encrypted communication tool WhatsApp. Here's what we know.

Aug. 22 2022, Published 2:59 p.m. ET

Big banks like JPMorgan (JPM) and Bank of America (BOFA) are seeing massive fines for using the encrypted communication tool WhatsApp.

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are spearheading fines in an effort to maintain transparency in the financial industry.

Big banks are using WhatsApp to communicate — why that’s a problem.

For businesses at the intersection of banking and public stock, regulation can have a stronghold. The SEC and CFTC have been investigating large banks’ record-keeping practices since last year, scrutinizing the use of third-party apps like WhatsApp and more as well as email. By communicating through these unapproved avenues, banks are able to skirt securities laws that require businesses to be strict about keeping records.

The fines are part of a broader industry “sweep,” as anonymous sources who informed Reuters said in 2021. Keeping records is crucial to being both a bank and a public company, and failing to communicate in a way that preserves all actions a company takes (and the intent behind those actions) can lead to a dangerous lack of transparency.

When the SEC and CFTC want to investigate a bank, unauthorized communication methods make it difficult to access the necessary evidence. Whatever they’re investigating, a lack of records makes enforcing the rules practically impossible. By securing the third-party communication practices that go on in major banks, regulators can shore up their own success.

Which banks are paying fines for WhatsApp communication?

Big banks are facing up to $2 billion in fines that will go to the SEC and CFTC (and some have already paid).

Regulators fined a broker-dealer subsidiary of JPMorgan Chase in 2021 to the tune of $200 million. JPMorgan acknowledged fault. Both the SEC and CFTC received some of the fine money.

Morgan Stanley (MS) plans to pay $125 million to the SEC and another $75 million to the CFTC. In boasting its cash reserves, the company also shared it will reserve that $200 million in its balance sheet for the fine.

Bank of America is currently working on reaching a settlement with regulators over its failure to avoid unauthorized business communication. However, it has already packaged $200 million for the issue.

The SEC is still investigating Citigroup (C). Like the others, Citigroup is posited to have communicated through authorized channels. Similarly, Goldman Sachs is working to come to a resolution.

Barclays (BCS) will pay $200 million and Credit Suisse Group (CS) has reserved $200 million for litigation costs pertaining to the communication rules. Deutsche Bank (DB) and UBS Group (UBS) face investigations of their own.

Will others face fines? Possibly. SEC Chair Gary Gensler appears laser-focused on maintaining his momentum. While neither the SEC or CFTC have commented on the fines, others in the financial industry are checking themselves in case regulators flock their way.

The CEO of business messaging company Symphony Brad Levy told reporters, “Most believe the breadth of these investigations will go wider as they go deeper.”