Renee Blakely

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Renee Blakely

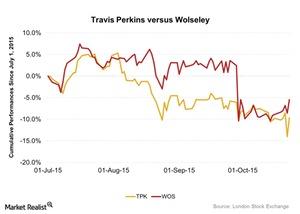

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.

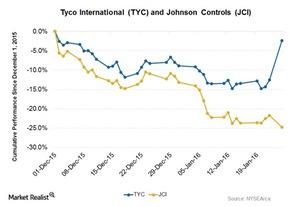

Tyco International to Tie Up with Johnson Controls

Tyco International (TYC) and Johnson Controls (JCI) revealed on Monday, January 25, 2016, that they are going to merge. The news raised TYC stocks that day, while JCI fell 3.9%.

How Has the Russian Stock Market Changed?

The Russian stock market is upbeat, which adds to the ruble’s strength.

SPY’s Struggle with Wall Street Continues

Of the 502 constituent stocks of SPY, only 23 recorded positive returns on Wall Street on August 20. Only seven stocks traded at a closing price above their moving averages.