Pearl Adams

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Pearl Adams

How Does AES Corporation Categorize Its Businesses?

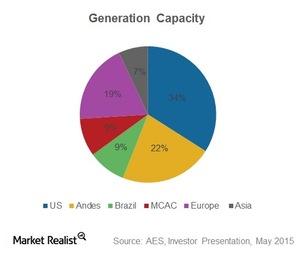

AES Corporation (AES) is a diversified power generation and utility company. It operates its business under six SBUs (strategic business units).

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.

AES Corporation: Its Evolution Up until Now

AES Corporation is a global entity and operates through its six strategic business units, created based on the geographical areas they cater to.

Southern Company Is a Diversified Utility Company

Southern Telecom is a telecommunications subsidiary of Southern Company. It provides dark fiber optic solutions to various businesses.