Marijuana Legalization: House Passes SAFE Act in US

Yesterday, the House passed the Secure and Fair Enforcement Banking Act, which aims to reduce cash transactions for legitimate marijuana businesses.

Nov. 20 2020, Updated 4:54 p.m. ET

Imagine operating a legitimate marijuana business in the US without banking support. You couldn’t accept card payments or wire money to your suppliers. Paying employees or tax through your banking account would also be out of the question.

The above is an unfortunate reality for legitimate cannabis businesses operating in the US. They have no choice but to conduct business in cash. According to Bloomberg, states that have legalized recreational cannabis collected $1.3 billion in related tax last year, and are expected to collect $1.9 billion this year.

What’s the issue?

In the US, cannabis or marijuana-related activities are not legal under federal law. However, each state has the freedom to allow cannabis for medical or recreational purposes in their territory. As a result, 33 states and the District of Columbia allow the sale and consumption of marijuana.

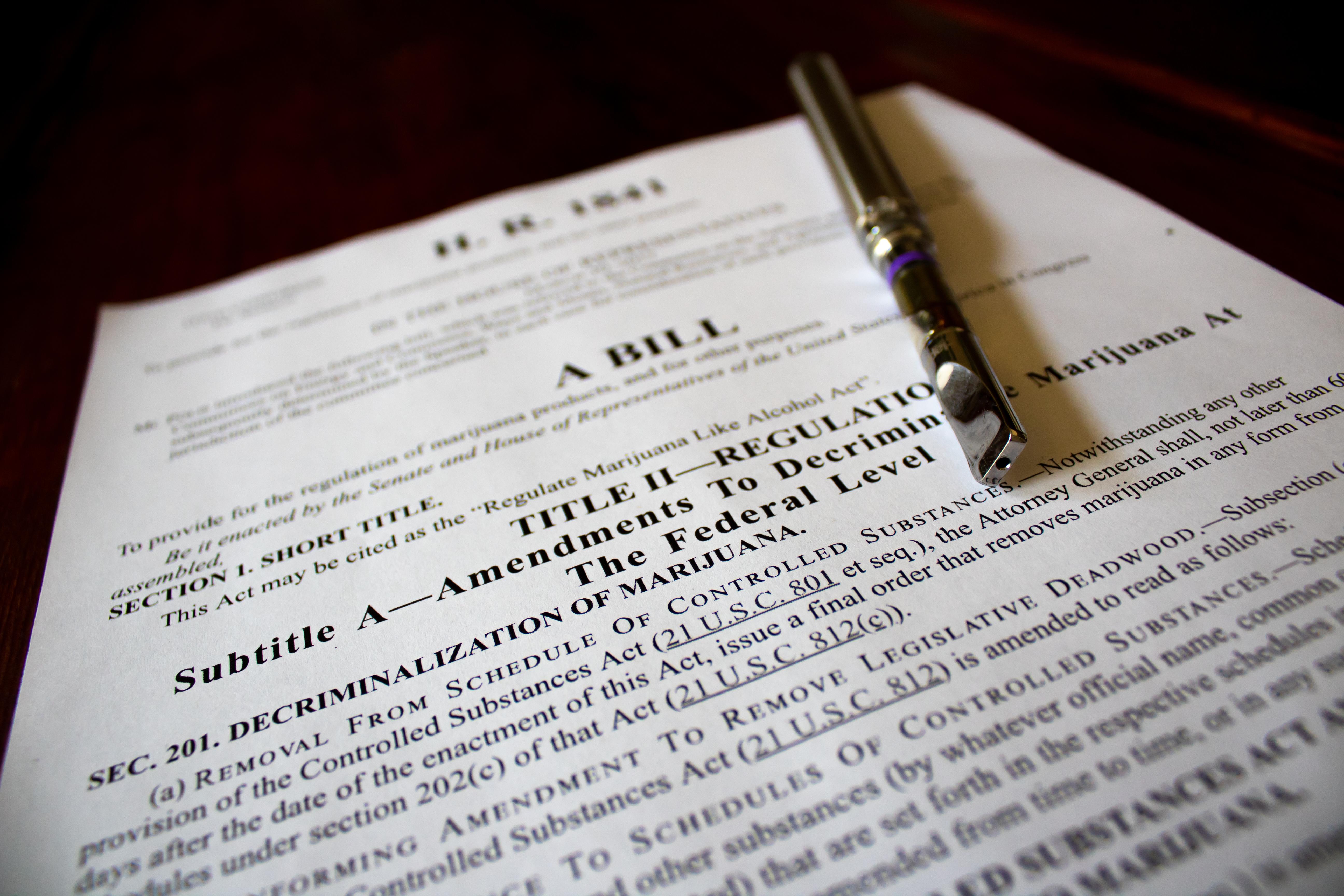

Marijuana bill passed

The disparity between federal and state laws calls for a more sensible approach to handling US business transactions. Furthermore, there has been pressure to ease US cannabis regulations since Canada legalized recreational cannabis last year. Canada is also set to legalize edibles next month.

The SAFE (Secure and Fair Enforcement) Banking Act of 2019 is set to solve some of these problems. The act was introduced on March 7. Yesterday, almost six months later, the House of Representatives passed the bill, with 321 to 103 votes in favor of the bill.

SAFE aims to reduce cash transactions for legitimate marijuana businesses. Some key points are as follows:

- Banks or depository institutions providing services to legitimate cannabis businesses may not have limits to deposit insurance.

- Banks providing accounts to owners, employees, or operators of legitimate marijuana businesses will be protected.

- Depository institutions can also make loans to legitimate cannabis businesses and their employees, operators, owners, or service providers.

As we can see above, the SAFE Banking Act opens doors for cannabis businesses.

Curaleaf’s views on the bill

Curaleaf (CURA)(CURLF) issued a statement welcoming the bill’s passage. The company called this an “important first step” in enabling cannabis companies to perform transactions like other businesses.

Acreage Holdings (ACRGF)(ACRG) also welcomed the move. Chairman and CEO Kevin Murphy said, “The bill, which would deliver access to traditional banking services for the over 10,000 legal cannabis businesses in the U.S., promotes the safety, transparency and certainty that the cannabis industry, the fastest growing sector of the U.S. economy, needs to prosper.”

With this positive momentum toward legalization, the possibility of Canopy Growth (WEED)(CGC) acquiring Acreage may become a reality. Meanwhile, analysts’ estimates for Canopy are subdued.

Other states and marijuana

Other states are also moving toward legalization. South Dakota and Wisconsin recently introduced bills to legalize medical marijuana. Outside the US, Mexico is also moving toward legalizing marijuana.