Why Charlotte’s Web Holdings’ Revenue Is Expected to Spike

In the third quarter, Charlotte’s Web Holdings (CWBHF) reported revenues of $17.7 million, which represents YoY organic growth of 57%.

Jan. 4 2019, Updated 9:40 a.m. ET

Performance in 2018 YTD

In the third quarter, Charlotte’s Web Holdings (CWBHF) reported revenues of $17.7 million, which represents YoY organic growth of 57%. Charlotte’s Web Holdings reported $48.0 million in revenues in the first nine months of 2018, a YoY rise of 75%.

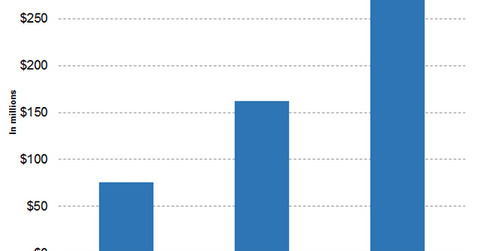

Revenue projections

Wall Street analysts expect Charlotte’s Web Holdings to report revenues of $75.61 million in fiscal 2018. The company is also expected to report revenues of $161.93 million in fiscal 2019, a YoY rise of 114.16%. Wall Street estimates Charlotte’s Web Holdings’ fiscal 2020 revenues will be $279.88 million, a YoY rise of 72.84%. Wall Street analysts have also projected Charlotte’s Web Holdings’ revenues to be close to $27.77 million in the fourth quarter.

According to the company’s investor presentation, Charlotte’s Web Holdings expects to report revenues in the range of $65 million and $80 million in fiscal 2018, a YoY rise of $25 million to $40 million. The company has also forecasted its fiscal 2019 revenues to fall in the range of $120 million to $170 million.

2018 Farm Bill

On December 20, 2018, Charlotte’s Web Holdings issued a press release highlighting an improved outlook for its business prospects due to the passing of the 2018 Farm Bill. This bill classifies hemp as an agricultural commodity, so it’s no longer governed by the Drug Enforcement Administration (or DEA) under the Controlled Substances Act (or CSA). According to the press release, this legal change will enable easier production and distribution of hemp-based products in the US market, which benefits Charlotte’s Web Holdings.

Prominent cannabis players such as Canopy Growth (WEED) and Tilray (TLRY) also want to leverage the opportunity in the hemp segment. To know more about this trend, please read Canadian Cannabis Companies Set Sights on US Hemp Market.

In the next article, we’ll discuss earnings growth trends for Charlotte’s Web Holdings in greater detail.