What Are Analysts Expecting for Starbucks’s Revenue in 2019?

Starbucks’s (SBUX) management expects its revenue to rise 5%–7% in fiscal 2019.

May 30 2019, Published 1:32 p.m. ET

Management’s guidance

Starbucks’s (SBUX) management expects its revenue to rise 5%–7% in fiscal 2019. For the same period, management expects the company’s SSSG (same-store sales growth) to be in the range of 3%–4%.

The company plans to open 2,100 new restaurants this year: 600 in the Americas segment, ~1,110 in the China and Asia-Pacific segment, and ~400 in the EMEA (Europe, the Middle East, and Africa) segment.

Analysts’ expectations

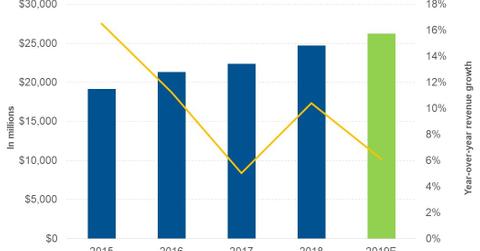

For fiscal 2019, analysts expect Starbucks (SBUX) to post revenue of $26.23 billion, which implies a rise of 6.1% from $24.72 billion in fiscal 2018. The opening of new restaurants and positive SSSG are likely to drive the company’s revenue. However, some of the growth in the company’s revenue is likely to be offset by its streamlining initiatives.

Starbucks continues to emphasize the in-store experience, beverage innovations, the expansion of its delivery service, and its growing digital relationships to drive its SSSG. The company plans to have Nitro Cold Brew beverages in all its all of its company-operated restaurants in the United States by the end of this year.

In partnership with Uber Eats, Starbucks has expanded its delivery service to seven major markets across the United States, covering ~1,600 restaurants. In China, Starbucks has partnered with Alibaba (BABA) for the Starbucks Delivers program. By the end of December 2018, the company had deployed the service in 2,100 restaurants in 35 cities. Its management plans to expand the service to 3,000 restaurants spanning 50 cities by the end of fiscal 2019. The company also aims to have Mobile Order and Pay in China by the end of the year. Along with these initiatives, the growth in membership in the Starbucks Rewards program and the opening of Starbucks Reserve Roasteries to enhance the customer experience are expected to drive the company’s sales this year.