Why Autodesk Stock Might Move Higher despite High Valuation

The stock of software and services design company Autodesk (ADSK) has generated returns of 39% in the last 12 months.

April 16 2019, Published 12:31 p.m. ET

Stock returns

The stock of software and services design company Autodesk (ADSK) has generated returns of 39% in the last 12 months. The stock outperformed broader markets last year and gained 15%. Since the start of 2019, the stock is up by 34%.

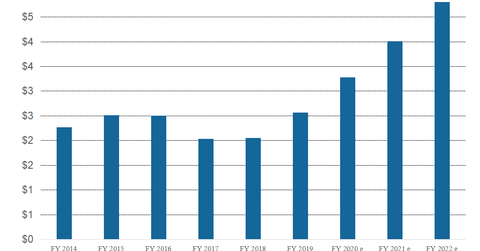

Autodesk stock has generated returns of 190% in the last three years and is up 260% in the last five years. These returns are despite the company’s earnings decline at a compound annual growth rate of 9% in the last five years. The company’s sales fell from $2.27 billion in 2014 to $2.05 billion in 2018. Sales are however estimated to reach $4.80 billion by fiscal 2022.

ADSK stock is currently trading 0.4% below its 52-week high of $173.44 and 47% above its 52-week low of $117.72. With an RSI (relative strength index) score of 97, Autodesk stock is now trading way above overbought territory.

Is Autodesk stock overvalued?

Autodesk is a high growth company and is expected to trade at a higher PE valuation. Autodesk has a high forward 2020 PE ratio of 120.0x. For 2021, this ratio is 53.2x. Analysts expect Autodesk sales to rise by 27.8% in fiscal 2020 and by 22.3% in 2021. Its EPS are expected to rise by 181% in 2020 and by 70% in 2021.

Its EPS could grow at a significant CAGR of 87% over the next five years. The stock looks undervalued despite its high valuation ratio. Autodesk’s net margin is expected to improve from -3.1% in 2019 to 23.5% in 2022.

Analysts’ recommendations

Of the 23 analysts covering Autodesk, 19 have given it “buy” recommendations, three have given it a “hold” recommendation, and one has given it a “sell” recommendation. The average 12-month target price for ADSK is $182.64, which indicates a potential upside of 5.7% from its current level.