Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

May 14 2019, Published 11:15 a.m. ET

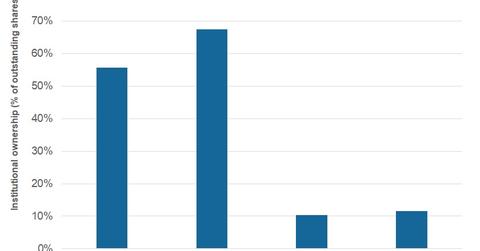

Institutional ownership in integrated energy stocks

Now, we’ll review the changes in institutional ownership in BP (BP), Chevron (CVX), Royal Dutch Shell (RDS.A), and ExxonMobil (XOM) in the first quarter. Institutional ownership is the highest in Chevron, standing at ~67%. The lowest institutional ownership is in Shell at ~10%. Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

Institutional ownership in XOM and CVX

According to 13-F filings for the quarter ending March 31, 2019, BlackRock Institutional Trust Company has lowered its holdings in ExxonMobil as well as Chevron. BlackRock is one of the top four institutional holders in XOM and CVX.

In the past six months, T. Rowe Price Associates and Federated Investment Management Company were the highest sellers of ExxonMobil stock. Similarly, Fidelity Management and Research Company and Alleghany Capital Partners were the highest sellers of Chevron stock.

However, the Vanguard Group was the highest buyer of ExxonMobil and Chevron in the past six months. Capital Research Global Investors also bought a large quantity of ExxonMobil stock in the same period. Similarly, Capital International Investors is the second-highest buyer of Chevron stock in the past six months.

Institutional ownership in Shell and BP

In the first quarter, Fisher Investments and Boston Partners raised their holdings in Shell stock. These firms are among the top four holders of Shell stock. In the past six months, Fisher Investments was the highest buyer of Shell stock.

Further, Dimensional Fund Advisers has lowered its holdings in BP stock in the first quarter. In the past six months, Fidelity Management and Research Company and BlackRock Investment Management were the highest buyers of BP stock. However, Arrowstreet Capital and Pzena Investment Management are the highest sellers of the stock.