Comparing the Revenue Growth Trajectories of PFE and GSK

On its first-quarter earnings conference call, Pfizer (PFE) maintained its 2019 revenue guidance of $52 billion–$54 billion.

May 7 2019, Published 2:56 p.m. ET

Revenue performance

On its first-quarter earnings conference call, Pfizer (PFE) maintained its 2019 revenue guidance of $52 billion–$54 billion. The company, however, expects revenue pressure to result from increased competition for Viagra and the authorized generic of Viagra launched by its subsidiary Upjohn in 2019. Additionally, the upcoming loss of exclusivity for Lyrica is expected to push Upjohn’s revenue down in 2019 as well as in 2020. To learn more about Pfizer’s revenue growth estimates, read Pfizer Reiterated Its Fiscal 2019 Revenue Guidance.

In its first-quarter earnings press release, GlaxoSmithKline (GSK) reiterated its Group sales guidance of the low- to mid-single-digit percentage CAGR (compound annual growth rate) it first announced in May 2015 for the timeframe of 2016–2020. The company reaffirmed its sales guidance on December 3, 2018. This guidance assumed the generic erosion of Advair in the US market and was based on 2015 exchange rates. The guidance also factored in the recently completed acquisition of Tesaro, the formation of its consumer healthcare joint venture with Pfizer, the divestiture of Horlicks and other brands to Unilever, the divestiture of 130 noncore brands in 2017, and the planned divestiture of the Consumer Healthcare nutrition business.

Revenue projections

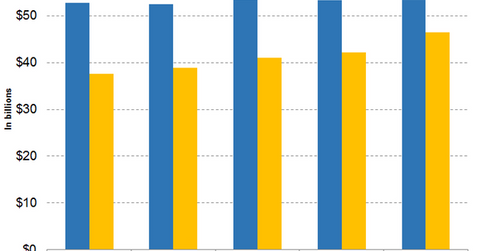

Wall Street analysts expect Pfizer’s revenues to be $53.28 billion, $53.82 billion, and $55.82 billion, respectively, in 2019, 2020, and 2021. These estimates imply YoY (year-over-year) revenue changes of -0.68%, 1.01%, and 3.72%, respectively. Pfizer’s revenue is expected to grow at a CAGR of 1.33% from 2018 to 2021.

On the other hand, Wall Street analysts expect GlaxoSmithKline’s revenues to be $42.12 billion, $46.48 billion, and $48.23 billion, respectively, in 2019, 2020, and 2021. These estimates imply YoY revenue rises of 2.53%, 10.34%, and 3.77%, respectively. GlaxoSmithKline’s revenue is expected to grow at a CAGR of 5.49% from 2018 to 2021.