Analysts Expect NIO to Outperform TSLA, TCEHY, BIDU, and BABA

According to the latest consensus data compiled by Thomson Reuters, six out of a total of 12 analysts covering NIO (NIO) recommended a “buy” for the stock.

May 24 2019, Published 2:57 p.m. ET

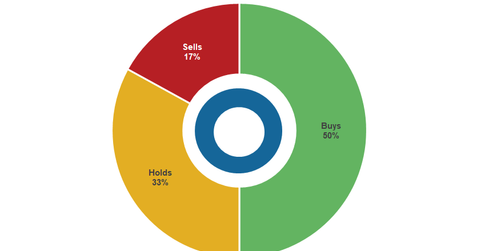

Analysts’ ratings on NIO

According to the latest consensus data compiled by Thomson Reuters, six out of a total of 12 analysts covering NIO (NIO) recommended a “buy” for the stock. Four of these 12 or 33% of analysts suggest a “hold” while the remaining two analysts or 17% say to sell NIO stock as of May 23.

Analysts’ price target for NIO stock

Wall Street analysts’ consensus price target data suggest that NIO stock could reach $7.81 in the next 12 months. This price target reflected about 98.7% upside potential from yesterday’s closing price of $3.93 on the NYSE.

Earlier today, NIO stock posted an all-time low of 3.82. Investors’ low expectations for the company’s first-quarter earnings—along with an ongoing sell-off in US-listed Chinese companies—is driving its stock lower.

Recommendations for Tesla

Only about 32% of analysts covering NIO’s US peer Tesla (TSLA) recommend a “buy” with a consensus price target of $274.01. The target price reflects an upside potential of 40.2% from Tesla’s closing price of $195.49 yesterday.

Over the last couple of weeks, analysts from Morgan Stanley and Citigroup have raised concerns about the ongoing US-China trade war’s negative impact on Tesla’s car demand in the Chinese market. Tesla is gearing up to challenge NIO in its home market as the US carmaker started building its third Gigafactory in Shanghai in January.

Upside potential for NIO versus TCEHY, BIDU, and BABA

Interestingly, analysts expect NIO to yield far better returns than its much larger home-market peers, including Tencent Holdings (TCEHY), Baidu (BIDU), and Alibaba (BABA).

Analysts expect Tencent Holdings to yield a 36.1% positive return in the next 12 months. At the same time, analysts see about 56.1% and 38.5% upside potential in Baidu’s and Alibaba’s US-listed shares as of May 23.

In 2019 so far, NIO, Tesla, Tencent Holdings, and Baidu have lost 22.9%, 30.1%, and 30.9%, respectively. In contrast, the Chinese e-commerce giant Alibaba has risen 13.8% year-to-date.