A Look at Western Digital’s and Seagate’s Financial Metrics

Western Digital (WDC) is one the major players in the global storage market.

Oct. 9 2017, Updated 7:39 a.m. ET

WDC

Western Digital (WDC) is one the major players in the global storage market. The firm has a market cap of approximately $24 billion, an enterprise value of $32.3 billion, and a beta of 1.2. WDC has an enterprise-value-to-revenue ratio of 1.69x and an enterprise-value-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio of 7.53. Its forward PE (price-to-earnings) ratio is 7.31x, and its trailing-12-month price-to-sales ratio is 1.28x.

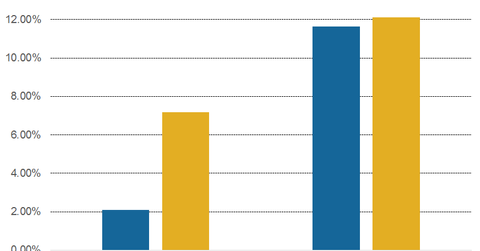

WDC has a net profit margin of 2.1% and an operating margin of 11.6%. In the trailing-12-month period, the firm’s return on assets was 4.4%, whereas its return on equity is 3.5%. In the last 12 months, WDC’s stock has risen over 40% compared to the S&P 500’s return of 18%.

Seagate

Seagate (STX) has a market cap of approximately $10 billion, an enterprise value of $12.4 billion, and a beta of 1.66. Seagate has an enterprise-value-to-revenue ratio of 1.13x and an enterprise-value-to-EBITDA ratio of 5.91x. Its forward PE ratio is 8.78x, and its trailing 12-month price-to-sales ratio is 0.91x.

Seagate has a net profit margin of 7.2% and an operating margin of 12.1%. In the trailing-12-month period, the firm’s return on assets is 9.3%, whereas its return on equity is 52.2%. In the last 12 months, Seagate stock has fallen over 10% compared to the S&P 500 return of 18%.