A Look at Autodesk’s Revenue and Earnings Growth

Autodesk’s (ADSK) sales declined at a compound annual growth rate (or CAGR) of 2.5% between fiscal 2014 and fiscal 2018.

May 20 2019, Published 8:04 a.m. ET

Revenue estimated to reach $4.8 billion in fiscal 2022

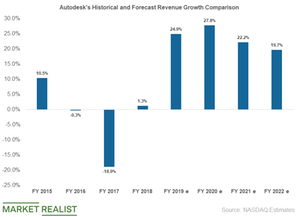

Autodesk’s (ADSK) sales declined at a compound annual growth rate (or CAGR) of 2.5% between fiscal 2014 and fiscal 2018. The company’s sales fell from $2.27 billion in fiscal 2014 to $2.06 billion in fiscal 2018. However, the company seems to be at the start of a turnaround, as sales rose 25% in fiscal 2019. Autodesk’s revenue is in fact estimated to rise by a CAGR of 23% between fiscal 2019 and fiscal 2022.

The above chart shows Autodesk’s year-over-year historical and forecast revenue growth rate.

Robust earnings growth will drive Autodesk’s bottom line

While Autodesk’s revenue is estimated to rise by 27.8% to $3.28 billion in fiscal 2020, its adjusted earnings per share are estimated to rise by a more than impressive 180.2%. In comparison, Autodesk’s sales are expected to rise by 22.4% in fiscal 2021, while its earnings are expected to rise 70.7%.

Autodesk’s earnings per share are estimated to rise at a CAGR of 86.7% over the next five years. In comparison, the company’s EPS fell at a CAGR of 9% in the last five years. Autodesk has a high operating leverage of 5.85x this year, which means that for every dollar of increase in sales, the company’s operating profit will increase by $5.85.