Why Tesla’s Model 3 Gross Margin Contracted in Q1 2019

In the first quarter, Tesla’s consolidated gross profit stood at $566 million, down 60.8% from the company’s gross profit of $1.44 billion in the fourth quarter.

April 25 2019, Published 8:10 a.m. ET

Tesla’s gross profit in the first quarter

In the first quarter, Tesla’s (TSLA) consolidated gross profit stood at $566 million, down 60.8% from the company’s gross profit of $1.44 billion in the fourth quarter of 2018 and up 23.9% from $457 million in the first quarter of 2018.

Automotive gross margin

With this, the company’s first-quarter consolidated gross margin stood at 12.5%, down from 20.0% in the fourth quarter of 2018 and 13.4% in the first quarter of 2018. Adding to the pessimism, Tesla’s first-quarter consolidated gross margin was also worse than analysts’ consensus estimate of 17.2%.

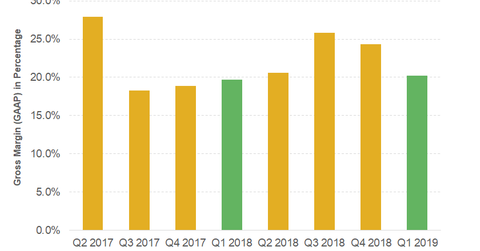

In the first quarter of 2019, Tesla’s GAAP (generally accepted accounting principles) gross margin in the Automotive segment was 20.2%, lower than 24.3% and 25.8% in the fourth and third quarters of 2018, respectively. However, it was slightly better than its GAAP gross margin of 19.7% in the first quarter of 2018.

What hurt the Model 3’s gross margin?

Unlike in the fourth quarter of 2018, Tesla’s gross margins from the Model S and X contracted in the first quarter of 2019. Price cuts in the Models S and X along with lower deliveries affected the gross margins of these models in the quarter.

In the first quarter, Tesla’s Model 3 gross margin contracted to ~20%. During Tesla’s first-quarter earnings conference call, its CFO, Zachary Kirkhorn, blamed recent Model 3 pricing adjustments and high demand for lower-priced Model 3 variants for the contraction in the Model 3’s gross margin.

NIO (NIO), which competes with Tesla in China, launched its lower-priced SUV electric model, the ES6, in December 2018. This release could be another reason why Tesla decided to cut its vehicle prices in China in the first quarter.