Is Kroger Losing to Walmart, Target, and Costco?

Kroger (KR) stock underperformed the broader markets in the first quarter and fell 10.5%. In comparison, the S&P 500 rose 13.1%.

April 5 2019, Published 8:05 a.m. ET

Stock performance

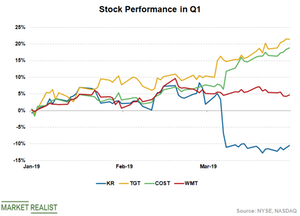

Kroger (KR) stock underperformed the broader markets in the first quarter and fell 10.5%. In comparison, the S&P 500 rose 13.1%. Walmart (WMT), Costco (COST), and Target (TGT) shares rose 4.7%, 18.9%, and 21.4%, respectively.

On a YTD basis as of April 4, Kroger stock has fallen 13.9%. Target, Costco, and Walmart stock have risen 23.1%, 20.0%, and 5.3%, respectively.

What’s behind the underperformance?

Kroger’s underperformance stems from its weak financials. The company missed analysts’ sales and EPS estimates in the fourth quarter. Kroger’s earnings fell on a YoY (year-over-year) basis due to soft sales and continued investments in growth measures to defend its market share amid more competitive activity. The company’s EPS guidance fell short of analysts’ expectations, which dragged the stock down.

Retailers’ bottom lines have been impacted by investments in the price and other growth measures including expanded digital offerings. Target and Walmart have expanded their digital capabilities. Costco continues to widen its value gap with its peers and attract consumers.

Amid more competition, Kroger is investing in growth measures like its Restock program. Growth investments and more competition are taking a toll on Kroger’s sales and profitability.