When Can Disney Resume Its Share Buyback Program?

Disney has suspended its share repurchase program temporarily due to its heavy debt load.

April 11 2019, Published 11:54 a.m. ET

BMO Capital’s view

BMO Capital analyst Daniel Salmon has upgraded his rating on the Walt Disney Company (DIS) to an “outperform” due to his positivity about its launch of Disney+ and its Star Wars–based theme parks. Salmon also expects the company to pursue share buybacks next year.

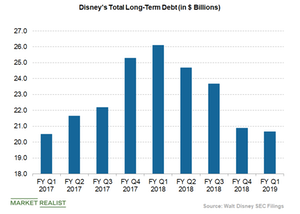

Disney has suspended its share repurchase program temporarily due to its heavy debt load. It expects to resume share repurchases after it improves its cash-to-debt ratio with a single A credit rating. Its cash-to-debt ratio was 0.22 on December 31, 2018, better than its level of 0.20 in the preceding quarter. A company can pay off its debt using its cash in hand if its ratio is higher than 1.

Disney focuses on reducing its debt load

Disney’s debt load is high due to its 21st Century Fox acquisition (in half cash and half stock) and the upcoming launch of its Disney+ streaming service. Disney also acquired debt of ~$19.2 billion from Fox.

Meanwhile, the company is making efforts to reduce its debt load. It reduced its debt amount from $26.09 billion at the beginning of 2018 to $20.66 billion at the end of 2018. Its sale of a 39% stake in London-based Sky to Comcast (CMCSA) for ~$15.3 billion in September helped it reduce its debt load and invest in its Disney-branded direct-to-consumer offering.

Last month, Disney sold its 80% stake in regional sports network YES (Yankee Entertainment and Sports) Network to the New York Yankees for $3.5 billion, which further helped it lessen its debt load. Amazon (AMZN), Sinclair Broadcast Group (SBGI), and Blackstone (BX), which are the leading investors in the New York Yankees, hold a combined 20% stake in YES.