What to Expect from Groupon’s Revenue and Earnings Growth

Groupon’s (GRPN) sales have been falling over the last few years, as the company has exited unprofitable international markets.

April 12 2019, Published 8:21 a.m. ET

Groupon’s sales are expected to rise 8.2% in 2019

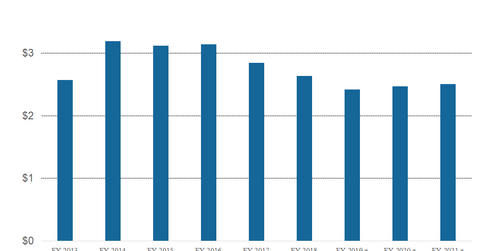

Groupon’s (GRPN) sales have been falling over the last few years, as the company has exited unprofitable international markets. Groupon reported sales of $3.19 billion in 2014 and revenue fell to $3.14 billion in 2016, $2.84 billion in 2017, and $2.63 billion in 2018.

As we can see in the chart below, analysts expect Groupon’s revenue to fall 8.2% YoY to $2.42 billion in 2019 compared to $2.64 billion in 2018. Its sales are then expected to rise 2.1% to $2.47 billion in 2020 and 1.5% to $2.5 billion in 2021.

In comparison, its non-GAAP (generally accepted accounting principles) EPS are expected to rise 11.1% in 2019 to $0.20 from $0.18 in 2018. The company’s EPS are then expected to rise 25% to $0.25 in 2020.

Analysts expect Groupon’s EPS to rise at a compound annual growth rate of 22.8% over the next five years, which is way higher than the EPS growth of 5.3% in the last five years.

Net margin set to double over the next two years

Driven by earnings growth, Groupon’s EBITDA is expected to rise from $268 million in 2019 to $298 million in 2020 and $314 million in 2021.

Its operating profit might also improve from $128 million in 2019 to $152 million in 2020 and $182 million in 2021. The company’s operating margin is expected to expand from 5.3% in 2018 to 6.1% in 2020 and 7.3% in 2021.

Similarly, the company’s net margin is expected to improve from 1.7% in 2019 to 3% in 2020 and 4.7% in 2021.