Intel’s Mobile Business: More Risks than Rewards

Intel (INTC) exited the 5G smartphone modem business immediately after Qualcomm (QCOM) and Apple announced the settlement of all their legal disputes.

April 22 2019, Published 3:02 p.m. ET

Rumors around Intel’s mobile business exit

Intel (INTC) exited the 5G smartphone modem business immediately after Qualcomm (QCOM) and Apple announced the settlement of all their legal disputes. These two announcements raised speculations that Intel’s decision to exit the 5G modem space forced Apple to settle. This speculation was fueled by an earlier rumor that the appointment of Bob Swan to Intel’s CEO position would lead to a reassessment of some business units that failed to generate desired returns. One of those business units was the mobile business unit.

The above rumor was confirmed in a press release where Bob Swan said, “In the smartphone modem business it has become apparent that there is no clear path to profitability and positive returns.”

Intel’s mobile business was never profitable

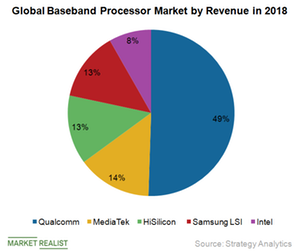

Intel entered the mobile market late, and its Atom processors failed to compete with Qualcomm’s ARM-based processors. So Intel adopted a contra revenue strategy under which it sold Atom chips at a highly subsidized rate. This strategy backfired as the chip gained just 1% unit share for a $4 billion loss in 2015. The company integrated its mobile business into its Client Compute business that year.

In 2016, Intel pulled the plug on its Atom X series processors used in mobile phones and tablets but continued to develop smartphone modems and secured a design win from Apple. Fast-forward to 2018, and Intel has already spent billions of dollars on modem technology and even succeeded in becoming Apple’s exclusive modem supplier. Despite Apple orders, the modem business wasn’t very profitable.

So Intel decided to exit the 5G modem business, and investors welcomed the decision, sending the stock up as much a 5% on April 17, when the decision was announced.