Could Ford’s Profit Margins Improve in Q1 2019?

In the fourth quarter of 2018, Ford (F) reported automotive segment EBIT (earnings before interest and taxes) of $1.1 billion, down 31.3% YoY.

April 23 2019, Published 8:59 a.m. ET

Trend in Ford’s profitability

In the fourth quarter of 2018, Ford (F) reported automotive segment EBIT (earnings before interest and taxes) of $1.1 billion, down 31.3% YoY. The company’s automotive EBIT margins also dropped sharply to 2.9% in the fourth quarter last year as compared to 4.3% in the fourth quarter of 2017. Ford reported EBIT losses from all other geographical markets except North America in the fourth quarter. Combined EBIT loss of $828 million from South America, Europe, the Middle East and Africa, and the Asia-Pacific region hurt the company’s profitability in the final quarter of 2018.

Estimates for Ford’s Q1 profit margins

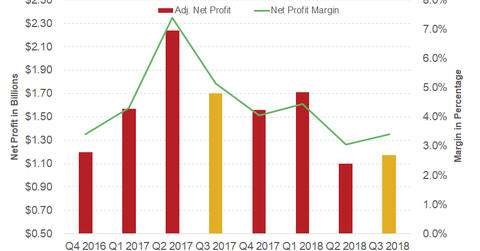

Wall Street analysts are estimating Ford’s first-quarter of 2019 adjusted pre-tax profit margin to be 3.6% this year. This estimate was much worse than the company’s 4.9% adjusted pre-tax profit margin in the first quarter of 2018.

Similarly, analysts estimate Ford will post an adjusted net profit margin of 2.9% in the first quarter this year, lower than its adjusted net profit margin of 4.4% in the first quarter of 2018.

In the first quarter, Ford’s US truck and SUV sales rose by 4.1% and 5.0%, respectively, on a YoY basis. However, the company hasn’t released its first-quarter retail and fleet sales separately so far.

A lower contribution of retail sales to Ford’s total US sales (IYK) could hurt its profit margins in the first quarter as retail sales tend to yield higher profitability as compared to fleet sales. Also, the lack of signs that we could see near-term improvements in Ford’s international market profitability could be keeping Wall Street analysts’ expectations low.