What Analysts Recommend for Chipotle

Target price As of December 28, 2017, Chipotle Mexican Grill (CMG) was trading at $294.06. On the same day, analysts were expecting the stock to reach $317.26 in the next four quarters, which represents a return potential of 7.9%. Before the announcement of Chipotle’s 3Q17 earnings, analysts had forecast a 12-month target price of $375.46. […]

Jan. 4 2018, Updated 7:36 a.m. ET

Target price

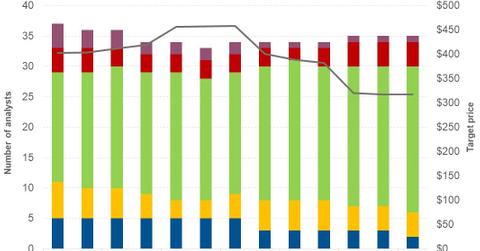

As of December 28, 2017, Chipotle Mexican Grill (CMG) was trading at $294.06. On the same day, analysts were expecting the stock to reach $317.26 in the next four quarters, which represents a return potential of 7.9%.

Before the announcement of Chipotle’s 3Q17 earnings, analysts had forecast a 12-month target price of $375.46. The company’s lower-than-expected 3Q17 earnings and lowering of its 2017 SSSG (same-store sales growth) guidance may have prompted analysts to lower their target prices. Peers’ target prices and potential returns are as follows:

Analysts’ ratings

Of the 35 analysts following Chipotle, 17.1% recommend “buy,” 68.6% recommend “hold,” and 14.3% recommend “sell.” Chipotle’s stock moves in tandem with analysts’ ratings. As analysts raise their target prices, the stock price of a company moves up, and vice versa. Whereas Chipotle is currently trading below analysts’ target price, investors should not consider it an automatic “buy.” Investors should analyze various factors, which have been discussed in this series, before making any investment decisions.

Valuation multiples

We’ve considered Chipotle’s forward PE (price-to-earnings) multiple for our analysis due to its high visibility in the company’s earnings. As of December 29, 2017, Chipotle was trading at 31.2x. On the same day, peers The Cheesecake Factory (CAKE) and Shake Shack (SHAK) were trading at multiples of 18.2x and 78.9x, respectively.