What to Expect from ServiceNow’s Revenue and Earnings Growth

ServiceNow (NOW) is banking on companies’ digital transformation to drive sales.

April 18 2019, Published 9:30 a.m. ET

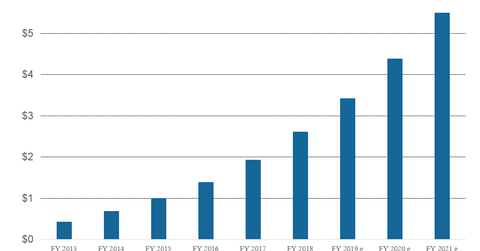

Revenue growth for 2019 estimated at 31.5%

ServiceNow (NOW) is banking on companies’ digital transformation to drive sales. Business transformation has been a primary focus for C-level executives worldwide. As we can see in the chart below, analysts expect ServiceNow’s revenue to rise 31.5% YoY to $3.43 billion in 2019 compared to $2.61 billion in 2018. It’s then expected to rise 28.1% to $4.4 billion in 2020 and 25% to $5.50 billion in 2021.

Earnings expected to rise close to 25% in 2019

ServiceNow’s earnings are expected to grow at a slower pace compared to sales this year. ServiceNow’s non-GAAP (generally accepted accounting principles) EPS are expected to rise by 24.9% in 2019 to $3.11 from $2.49 in 2018. The company’s EPS are then expected to rise 38% to $4.29 in 2020.

Analysts expect ServiceNow’s EPS to rise at a CAGR (compound annual growth rate) of 35% over the next five years, which, though impressive, is far below the CAGR of 128% in its EPS in the last five years.

Profit margins

ServiceNow’s operating margin could rise from 20% in 2018 to 21.2% in 2019. The company’s operating margin is expected to expand to 23% in 2020 and 24.5% in 2021.

ServiceNow is not yet GAAP profitable. Its net margin is estimated to rise from -1% in 2018 to -0.2% in 2019, 2.7% in 2020, and 5% in 2021.