NVIDIA’s Gaming Revenue Declines May Be Temporary

NVIDIA’s (NVDA) revenue declined due to weakness in the Gaming and Data Center segments.

Nov. 20 2020, Updated 4:02 p.m. ET

NVIDIA’s gaming segment

Previously, we saw that NVIDIA’s (NVDA) revenue declined due to weakness in the Gaming and Data Center segments. The company earns more than 50% of its revenue from gaming, which includes desktop gaming, notebook gaming, and gaming console.

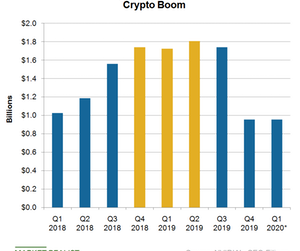

Generally, gaming revenue is high in the second half as holiday season sales pick up. However, volatility in the gaming business in the last two years due to the cryptocurrency cycle distorted the quarterly gaming trend. As the crypto bubble burst, fiscal 2019 fourth-quarter gaming revenue plunged 45% YoY and 46% sequentially to $954 million. This sharp decline slowed the full-year fiscal 2019 gaming revenue growth to 13% YoY from 35.8% last year. Three factors contributed to NVIDIA’s Gaming revenue decline.

Excess inventory

In the fourth quarter of fiscal 2019, NVIDIA’s Gaming segment revenues fell by $786 million. This decline was primarily due to the excess GPU (graphics processing unit) inventory in the channel after the crypto-bubble burst. NVIDIA stalled shipments of mid-range Pascal GPUs for the entire quarter to allow the channel to clear excess inventory, which was partly responsible for the revenue decline.

At the fiscal 2019 fourth-quarter earnings call, NVIDIA’s CFO Colette Kress stated that she expects channel inventory to normalize in the first quarter of fiscal 2020. Advanced Micro Devices’ (AMD) CEO, Lisa Su, expects its channel inventory to normalize in the second quarter of 2019.

Weak demand in China

NVIDIA’s gaming revenue was also impacted by weak macroeconomic conditions, particularly in China (FXI), where NVIDIA earns 25% of its overall revenue. Weak demand from China also impacted other companies with exposure to consumer markets such as Apple, Qualcomm, and Intel.

Slow uptake of Turing GPU

Gaming revenue declines were partly due to weaker-than-expected sales of its high-end Turing-based GeForce RTX GPUs that offer ray-tracing and artificial intelligence capabilities. The slow uptake probably came as consumers are waiting for prices to fall or for more ray-tracing supported games to come up.

NVIDIA expects the above headwinds to fade and growth to resume in the second half of fiscal 2020 as fundamentals of gaming remain intact. Next, we will see how fiscal 2020 will look for NVIDIA’s gaming business.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!