How Strong Does HEXO’s Balance Sheet Look in Q2?

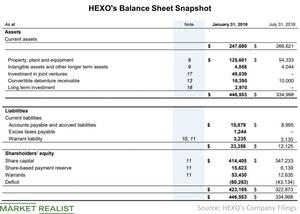

In the second quarter, HEXO (HEXO) had total assets of 446 million Canadian dollars, which increased year-over-year from 334 million Canadian dollars.

March 15 2019, Updated 9:44 a.m. ET

HEXO’s balance sheet

In the second quarter, HEXO (HEXO) had total assets of 446 million Canadian dollars, which increased year-over-year from 334 million Canadian dollars. The growth in assets was driven by an increase in cash and cash equivalents, trade receivables, notes receivables, and growth in inventory. The company’s fixed assets also grew nearly 2.3 times year-over-year.

However, the company had just about 23 million in liabilities, which increased year-over-year from 12 million Canadian dollars. Therefore, the company was light on leverage in Q2. The company still reported a deficit of about 60 million on the equity side as a result of losses from the current quarter.

Cash flow analysis

The company’s cash from operation was a negative 38 million due to an increase from a revaluation gain on biological assets, receivables, a net loss, prepaid investments, and an increase in investment in inventory. The company also saw an increase in investments in a fixed asset of 66 million Canadian dollars. The company funded these expenses through the issuance of common shares of nearly 57 million Canadian dollars as well as from the disposal of short-term investments.

The company’s balance sheet looks strong given that it carries low levels of leverage. This certainly must be taken into consideration when investors compare peers (HMMJ) like Canopy Growth (WEED), Tilray (TLRY), and Aphria (APHA).