How Did Kroger’s Margins Fare in 2018?

Kroger’s gross margin improved to 22.0% in the fourth quarter from 21.9% in the fourth quarter of fiscal 2017.

March 11 2019, Published 11:09 a.m. ET

Kroger’s gross margin

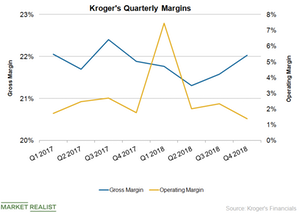

Kroger’s (KR) gross margin grew slightly in the fourth quarter of fiscal 2018 but fell in fiscal 2018, which ended on February 2. The company’s gross margin improved to 22.0% in the fourth quarter from 21.9% in the fourth quarter of fiscal 2017. Excluding fuel, the impact of an additional week in the fourth quarter of fiscal 2017 and LIFO (last in, first out) credit, Kroger’s gross margin fell by 93 basis points on a year-over-year basis in the fourth quarter. The decline reflected an unfavorable mix, continued investments in the supply chain, and lower pricing to stay competitive in the market.

On a reported basis, Kroger’s gross margin contracted by ~30 basis points to 21.7% in fiscal 2018. Excluding fuel, the impact of the 53rd additional week, and LIFO-related items, the company’s gross margin fell by 55 basis points in fiscal 2018. Lower pricing, supply chain investments, and higher transportation costs were a drag on the company’s fiscal 2018 gross margin.

Kroger’s operating margin fell to 1.4% in the fourth quarter from 1.8% in the fourth quarter of fiscal 2017. The operating margin deteriorated in the fourth quarter due to a rise in the operating, general, and administrative expense rate and higher depreciation and administrative expenses as a percentage of sales.

The company’s operating margin improved by ~10 basis points to 2.2% in fiscal 2018 on a reported basis. The improvement was driven by lower operating, general, and administrative expenses as a percentage of sales. The improvement was partially offset by a lower gross margin.

Margin outlook

Continued investments in growth initiatives and the need to maintain lower prices will likely continue to have a negative impact on Kroger’s margins in fiscal 2019. Kroger is implementing several cost control and efficiency measures to improve its margins. The company generated cost savings of over $1 billion through process improvements in fiscal 2018. Kroger is focusing on alternative profit streams, like Kroger Personal Finance, that carry higher margins.

Kroger expects a lower operating profit margin from fuel in fiscal 2019.

Next, we’ll discuss how analysts reacted to Kroger’s fourth-quarter results and outlook.