Broadcom’s Acquisitions Burden Its Balance Sheet with High Debt

At the end of fiscal 2018, Broadcom’s cash reserves stood at $4.3 billion, and long-term debt stood at $17.5 billion.

Nov. 20 2020, Updated 12:30 p.m. ET

Broadcom’s balance sheet

Previously, we saw that Broadcom’s (AVGO) profit margins benefitted from its M&A (mergers and acquisitions) activity. However, the downside of its M&A strategy is the high debt that it has accumulated.

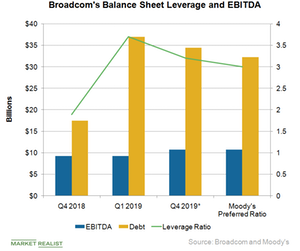

At the end of fiscal 2018, Broadcom’s cash reserves stood at $4.3 billion, and long-term debt stood at $17.5 billion, resulting in a net debt position of $13.2 billion. In fiscal 2019, the company’s long-term debt is expected to increase to $37 billion, as it will include the debt it took to fund the $18.9 billion acquisition of CA Technologies. The company plans to maintain its cash reserves at $4 billion. Broadcom management’s priority is to maintain an investment-grade credit rating. Credit rating agency Moody’s downgraded Broadcom to “Baa2,” which is an investment-grade rating.

What does Broadcom’s leverage ratio mean to investors?

Moody’s downgraded Broadcom, as it expects the CA Technologies acquisition will increase its total debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio from 2.0x to 3.7x. This ratio states that the company’s debt is 3.7 times its profit before interest payment. Broadcom’s leverage ratio will be higher than Qualcomm’s (QCOM) and Intel’s (INTC) leverage ratios of 2.63x and 0.83x, respectively.

Moody’s stated that it will upgrade Broadcom’s rating to the equivalent of BBB when its debt-to-EBITDA ratio falls to 3.0x. Assuming that Broadcom maintains its EBITDA margin at 44% in fiscal 2019, it will have to reduce its debt by $4.66 billion to achieve a ratio of 3.0x. If the company maintains its FCF at the fiscal 2018 level of $8.2 billion and spends the entire FCF after the $4 billion dividend payment on debt repayment, it can come close to the 3.0x debt-to-EBITDA ratio.

Moody’s doesn’t expect Broadcom to spend all of its remaining FCF on debt repayment. However, it expects the company to reduce the leverage ratio to low threes in fiscal 2019, which means the company will have to repay a debt of $2.5 billion.

Next, we’ll see if investors should be concerned about Broadcom’s high leverage.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!