Walmart’s Sam’s Club Continues to Impress with Comps Growth

The underlying sales at Walmart’s (WMT) Sam’s Club continued to impress and sustained momentum during the fourth quarter of fiscal 2019.

Feb. 22 2019, Updated 7:30 a.m. ET

Sustained momentum in underlying sales

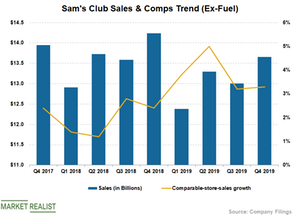

The underlying sales at Walmart’s (WMT) Sam’s Club continued to impress and sustained momentum during the fourth quarter of fiscal 2019 thanks to stellar growth in traffic. The segment’s comps (excluding fuel) rose 3.3% in the fourth quarter of fiscal 2019 driven by a 6.4% increase in traffic. However, its net sales fell 4.1% on a YoY (year-over-year) basis to $13.7 billion, reflecting a planned reduction in tobacco sales at certain clubs.

Sam’s Club’s comps benefited from growth across a majority of categories and the transfer of sales from its closed clubs. However, the removal of tobacco from certain clubs had an adverse impact on its comps by 2.0%. e-Commerce sales increased 21% driven by the expansion of direct-to-home and Club Pickup offerings. e-Commerce sales contributed 90 basis points to the company’s fourth-quarter comps growth rate.

Sam’s Club’s membership income rose 2.2% YoY due to growth in the Plus membership tier. Free shipping with no minimum order limit also drove the Plus membership tier. Its net sales (including fuel) fell 3.7%, but its comps rose 3.7%.

Sales by category

The grocery and beverages category reported high-single-digit growth in comps led by growth in soda, snacks, chips, and water. The consumables category marked low-single-digit growth in comps driven by broad-based growth. The fresh-freezer-cooler category reported a mid-single-digit increase in comps, reflecting continued growth in the cooler, deli, and frozen category.

Comps rose in the mid-single-digits in the home and apparel category driven by improved performances in apparel, toys, and home sales. The health and wellness category registered low-single-digit growth in its comps thanks to sustained momentum in the sales of over-the-counter products. The technology, office, and entertainment category remained weak and marked a mid-single-digit fall in comps. However, the mobile and gift card categories performed well.