iQiyi Stock Rises 21.7% on Robust Subscriber Growth

Chinese video streaming company iQiyi (IQ), a Baidu (BIDU) spin-off, had a spectacular $1.5 billion IPO in the United States last year.

Feb. 28 2019, Updated 3:05 p.m. ET

iQiyi reported a net loss of $1.3 billion last year

Chinese video streaming company iQiyi (IQ), a Baidu (BIDU) spin-off, had a spectacular $1.5 billion IPO in the United States last year. It has continued to grow robustly since then, driving Baidu’s growth.

The streaming giant’s revenue grew 52% YoY (year-over-year) to 25 billion yuan (or $3.6 billion) last year. However, like Netflix, iQiyi has continued to spend significantly on growing its content library. Baidu’s expenses surged during the fourth quarter, partly because its content costs (mostly attributable to iQiyi) jumped 75% last year to $3.42 billion.

IQiyi stock surged on Friday on tremendous subscriber growth

The streaming company said it lost a whopping 9.1 billion yuan (or $1.3 billion) last year, compared with a loss of 3.74 billion yuan (or $557 million) in 2017. Unlike Netflix, iQiyi has both ad-supported and subscription models.

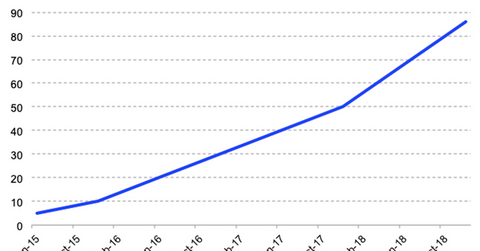

Last year, iQiyi’s subscriber count rose YoY to 87.4 million from 50.8 million. In comparison, iQiyi’s biggest competitor, Tencent (TCEHY) Video, had 82 million users at the end of last year’s third quarter. Despite being 31% below its peak last June, iQiyi stock soared 21.7% on February 22 on the NASDAQ as investors were pleased by the streaming company’s subscriber growth. The stock has risen 78.1% since going public.