What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

July 31 2017, Updated 9:11 a.m. ET

US iron ore volumes

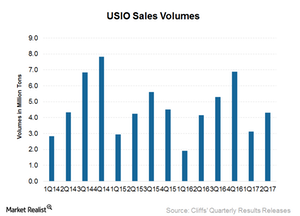

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices. A company’s shipped volumes usually depend on demand from end consumers. Cliffs’ USIO segment mainly sells iron ore to steelmakers (SLX) in the United States and Canada, such as AK Steel (AKS) and ArcelorMittal (MT). We’ll analyze Cliffs Natural Resources’ 2Q17 USIO volumes in this part of our series.

US Steel demand drives USIO volumes

Cliffs’ USIO achieved 4.3 million long tons in 2Q17, which represents growth of 4% YoY (year-over-year). These volumes were also higher than the company had originally expected due to customers’ increased appetite for pellets earlier in the shipping season. The company had guided for ~3.5 million tons of sales volumes for 2Q17.

Maintaining volume guidance

Cliffs Natural Resources (CLF) maintained its outlook for US volumes of 19 million tons for 2017. Investors should note that Cliffs produced 18.3 million tons of iron ore pellets in 2016.

Cliffs Natural Resources’ CFO, Timothy K. Flanagan, noted during the earnings call that the remaining ~11.5 million tons of volume will be weighted more toward the fourth quarter rather than the third quarter.

Cliffs Natural Resources’ CEO, Lourenco Goncalves, noted during the 2Q17 earnings call that the next thing driving volumes and prices in the domestic market should be the “self-initiated” Section 232 investigation into steel imports. He added, “We remain confident that some level of restrictive measure will be recommended soon.” He expects this investigation to be positive for the company’s US clients (NUE)(STLD), which should ultimately benefit the company.