Pfizer’s Expenses Are Expected to Rise in Fiscal 2019

Pfizer expects its adjusted SI&A expenses to fall by $13.5 billion–$14.5 billion in fiscal 2019—a decline of ~$200 million YoY at the midpoint.

Jan. 31 2019, Updated 7:31 a.m. ET

Expenses in fiscal 2018

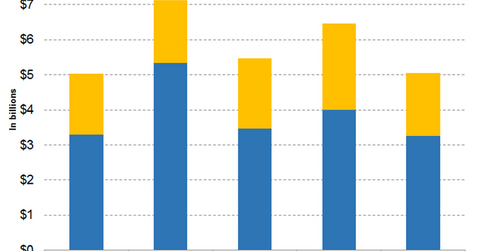

In fiscal 2018, Pfizer reported adjusted SI&A (selling, informational, and advertising) expenses of $14.23 billion—a decline of 2% YoY (year-over-year) on a reported basis and operational basis. The performance was in line with the fiscal 2018 adjusted SI&A expense guidance of $14.0 billion–$14.5 billion provided by the company in its third-quarter earnings conference call.

In fiscal 2018, Pfizer reported adjusted R&D (research and development) expenses of $7.96 billion—a rise of 4% YoY on a reported basis and operational basis. The performance was in line with the fiscal 2018 adjusted R&D expense guidance of $7.7 billion–$8.1 billion provided by the company in its third-quarter earnings conference call.

In fiscal 2018, Pfizer reported the adjusted cost of sales as a percentage of revenues of 20.7%. The performance was in line with the fiscal 2018 guidance of 20.8%–21.3% provided by the company in its third-quarter earnings conference call.

Analysts expect Pfizer to report R&D and SG&A expenses of $1.80 billion and $3.26 billion, respectively, for the first quarter. The estimates imply a YoY change of -0.82% and 3.48% in the SG&A expenses and R&D expenses, respectively, for the first quarter.

Expense projections for fiscal 2019

According to Pfizer’s fourth-quarter earnings conference call, the company expects its adjusted SI&A expenses to fall by $13.5 billion–$14.5 billion in fiscal 2019—a decline of ~$200 million YoY at the midpoint. While Pfizer expects a 3%–4% increase in direct SI&A expenses in fiscal 2019, the company is focused on controlling the total SI&A expenses by reducing indirect SI&A expenses.

According to Pfizer’s fourth-quarter earnings conference call, the company expects its adjusted R&D expenses to fall by $7.8 billion–$8.3 billion due to the investments required to support late-stage and early-stage projects.

According to Pfizer’s fourth-quarter earnings conference call, the company expects its adjusted cost of sales as a percentage of revenues to fall 20.8%–21.8% in fiscal 2019.

Next, we’ll discuss how Pfizer’s oncology portfolio performed in the fourth quarter and fiscal 2018.