Why Rising Debt Isn’t a Concern for Netflix

Netflix spent ~$5 billion on original content in 2016 and ~$6.0 billion on original content in 2017.

Jan. 4 2019, Updated 7:31 a.m. ET

Netflix’s investment in original content

Netflix (NFLX) has been investing in original movies and programming to grow its subscriber base. Netflix spent ~$5 billion on original content in 2016 and ~$6.0 billion on original content in 2017, and it’s planning to spend more than $8 billion on original programming as of the end of 2018.

According to the Diffusion Group, Netflix, Hulu, and Amazon’s (AMZN) Prime are expected to spend $10 billion annually and triple their combined investment in original shows by 2022. Apple also plans to allocate more than $4 billion to original content in 2022 from $0.5 billion in 2017, according to projections by venture capital company Loup Ventures.

Negative free cash flow

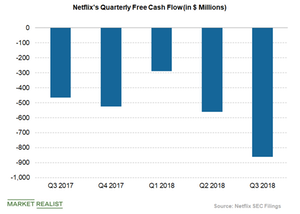

Netflix’s high spending on quality original content has resulted in significant negative free cash flow. In the third quarter, Netflix’s free cash flow was ~-$859 million, almost double its free cash flow of -$465 million in the previous year’s quarter and nearly triple its free cash flow of -$287 million in the first quarter of 2018.

For 2018, Netflix expects free cash flow of ~-$3 billion compared to -$2.0 billion in 2017. Netflix expects its free cash flow in 2019 to be almost the same as it was in 2018. The company expects to see negative free cash flows for several more years as it rapidly increases its spending on original content.

Netflix continues to raise its debt

Netflix is growing its debt levels, as it plans to spend on more original content, productions, hiring, and other acquisitions. As of September 30, Netflix had ~$3.1 billion in cash and cash equivalents and ~$8.3 billion in long-term debt. The company also raised $2 billion in new debt in October. Netflix’s debt-to-equity ratio was 166.4%. The company’s debt-to-total capital ratio was 0.63 at the end of the third quarter, meaning it had taken on more long-term debt than its peers.

Despite Netflix’s being a highly leveraged company, Mark Mahaney, an analyst at RBC Capital Markets, believes that its leverage ratios are reasonably good according to traditional media standards.