What Dragged Colgate-Palmolive’s Sales Down in Q4?

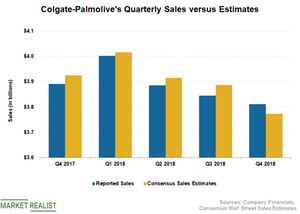

Colgate-Palmolive (CL) posted net sales of $3.8 billion, a decline of about 2% on a YoY (year-over-year) basis, as unfavorable currency rates hurt the top line by 5%.

Nov. 20 2020, Updated 12:27 p.m. ET

Q4 sales

Colgate-Palmolive (CL) posted net sales of $3.8 billion, a decline of about 2% on a YoY (year-over-year) basis, as unfavorable currency rates hurt the top line by 5%. However, net sales came in ahead of analysts’ expectation, thanks to improved organic sales.

Colgate-Palmolive’s organic sales increased 2%, driven by higher pricing (+2.5%). In comparison, Procter & Gamble (PG) and Kimberly-Clark (KMB) also posted healthy organic sales growth, thanks to higher pricing. Kimberly-Clark’s organic sales increased 3% while Procter & Gamble reported a 4% increase in its organic sales, driven by higher organic volumes and pricing, coupled with a favorable mix.

Sales by segment

North American sales increased 5.0%, driven by higher volumes (+3.0) and pricing (+2.5%). Currency volatility had an adverse impact of 0.5%. The increase reflects incremental sales from the company’s professional skincare acquisitions, which added 5% to the segment’s net sales growth. Organic sales inched up 0.5% as benefits from higher pricing were offset by lower organic volumes.

Sales in Latin America fell 9.0%, reflecting 3.5% decline in volumes, coupled with an adverse impact of 10% from currency fluctuations. However, pricing increased 4.5%. Volumes remained weak in Brazil and Argentina, offset in part by volume gains in Mexico. Organic sales rose 1% in Latin America.

Net sales in Europe declined 2.5%, reflecting lower pricing and adverse currency rates. Organic sales rose 1.0%, driven by higher volumes. The Asia-Pacific region’s net sales fell 6.5%, reflecting lower volumes in Greater China, coupled with a negative impact of 5.5% from currency volatility. Net sales in Africa and Eurasia decreased 5%, reflecting lower pricing and adverse currency rates. Pricing remained strong and increased 7.5%.

Hill’s net sales rose 6.0%, driven by higher volumes and pricing. Volumes improved in the United States and Western Europe.