Procter & Gamble’s Valuation Compared to Its Peers

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive.

Jan. 18 2019, Updated 7:30 a.m. ET

Valuation summary

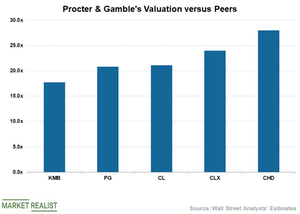

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive given the projected growth rate of 4.5% in its adjusted EPS in fiscal 2019. Procter & Gamble stock is trading on par with its five-year historical average trading multiple. Currently, Procter & Gamble shares offer a dividend yield of 3.2%.

In comparison, Procter & Gamble stock is trading lower than the peer group average of 22.7x. Colgate-Palmolive (CL), Clorox (CLX), and Church & Dwight (CHD) shares are trading at a forward PE ratio of 21.1x, 24.0x, and 28.0x, respectively. Kimberly-Clark (KMB) stock is trading at a forward PE ratio of 17.7x. The company’s peers offer better earnings growth and are trading at higher trading multiples.

Outlook

The recent recovery in Procter & Gamble stock indicates that the market has already priced in the positives. The company’s current valuation doesn’t look attractive, which could restrict the upside. Analysts expect Procter & Gamble’s top line to decline in the coming quarters. Negative currency rates and heightened competition will likely remain a drag.

Procter & Gamble’s earnings growth rate is projected to slow down. Weaker sales and higher commodity costs are expected to hurt the company’s bottom-line growth rate.