How to Counter China: Steel Could Show the Way

China (FXI) exported 5.56 million metric tons of steel in December, a yearly fall of 1.9%.

Jan. 27 2021, Updated 1:09 p.m. ET

China

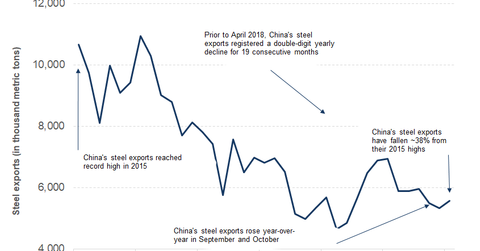

China (FXI) exported 5.56 million metric tons of steel in December, a yearly fall of 1.9%. However, exports rose 4.5% on a month-over-month basis. China’s steel exports have fallen ~38% from their 2015 highs. That year, Chinese steel exports had risen to their record high. Chinese steel exports surged to their record high at a time when global steel demand growth was tepid at best. Record Chinese steel exports were blamed for depressing global steel prices.

US steel companies

US steel companies (QQQ) including U.S. Steel (X) and AK Steel (AKS) had to shut down plants in 2015 as spot HRC (hot roll coil) prices plunged below $400 per ton levels. Nucor (NUE) and Steel Dynamics also saw their profitability erode as steel prices plunged.

As record Chinese steel exports decimated steel industries elsewhere, there was almost synchronized global action to stop Chinese steel exports from flooding domestic steel markets. Several countries imposed tariffs on Chinese steel products to fend off cheap Chinese steel from their borders. China also faced a backlash at global forums for its steel overcapacity. The net result was that China’s steel exports fell year-over-year in every year after 2015. Last year, Chinese steel exports fell 8.0% YoY.

What to make of current scenario

China had to shut down its excess industrial steel capacity, as avenues to export its excess produce dwindled. President Trump has been waging a trade war to change China’s behavior on trade practices. If steel is an indication, sustained global pressure could be the key for China to mend its trade policies.

Meanwhile, while China’s steel exports have fallen, the country’s aluminum exports surged to record highs last year. We’ll discuss this in detail in the next article.