Dick’s Sporting Goods’ Sales Growth Was Unimpressive in 2018

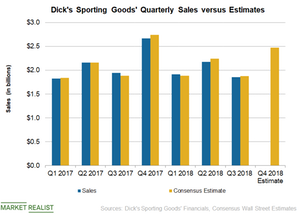

In the last ten quarters, Dick’s Sporting Goods (DKS) has missed analysts’ top-line estimates five times and surpassed them in the rest of the quarters.

Jan. 3 2019, Updated 9:00 a.m. ET

Sales numbers in 2018

In the last ten quarters, Dick’s Sporting Goods (DKS) has missed analysts’ top-line estimates five times and surpassed them in the rest of the quarters. For fiscal 2018, overall sales missed analyst estimates for two out of three quarters. Sales increased by 4.6% and 1.0% YoY in the first and second quarters, respectively. Weakness in the hunt and electronics category primarily impacted sales numbers.

However, the growing private brands business and sturdy e-commerce operations are expected to cushion the top line going forward. In the first three quarters of 2018, e-commerce sales have increased by 24%, 12%, and 16%, respectively.

In the third quarter, which ended on November 3, sales of $1.86 billion declined 4.5% YoY. A calendar shift along with weakness in the hunt and electronics categories hurt the company’s top line. The calendar shift wiped out $41 million from the top line.

The company hasn’t provided a sales outlook for either the fourth quarter or the fiscal year. However, analysts are projecting the company to report sales of $2.47 billion, representing a 7.1% decline on a YoY basis. For fiscal 2018, analysts expect sales to decline by ~2% YoY to $8.42 billion.

Comps are dismal

The comps have been impacted in all three quarters of 2018 by hunt and electronics’ muted performance. Management is moderating its hunting business and looking to exit the electronics category. Its comps were down 2.5% in the first quarter and 4% in the second quarter. In the third quarter, adjusted comps plummeted 3.9%, and on an unshifted basis, its comps declined by 6.1%. In fiscal 2018, Dick’s Sporting Goods expects fiscal 2018 comps to fall 3% to 4% compared with a 0.3% decline in fiscal 2017.

Peers’ top line trends

Big 5 Sporting Goods (BGFV) beat estimates for the first three quarters of 2018 and missed them on one occasion. On a YoY basis, sales declined in all three quarters.

Foot Locker (FL) sales beat analysts’ projections in the first three quarters of 2017. Sales increased in two out of three quarters on a YoY basis.