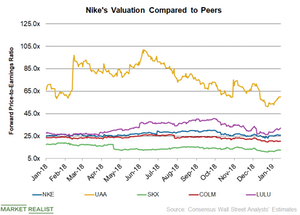

Comparing Nike’s PE Ratio with Its Peers

On January 14, Nike’s 12-month forward PE ratio was 25.8x. For fiscal 2019, analysts expect Nike’s adjusted EPS to increase 10.9% YoY to $2.65.

Jan. 16 2019, Updated 11:50 a.m. ET

Forward PE ratios

On January 14, Nike’s (NKE) 12-month forward PE ratio was 25.8x.

Under Armour (UAA), Skechers (SKX), Columbia Sportswear (COLM), and Lululemon Athletica (LULU) have forward PE ratios of 59.9x, 12.5x, 20.3x, and 32.3x, respectively.

Nike’s EPS projections

For fiscal 2019, Wall Street analysts expect Nike’s adjusted EPS to increase 10.9% YoY to $2.65. For fiscal 2020, analysts expect the company’s adjusted EPS to rise 18.4% YoY to $3.14.

Nike’s bottom-line growth is expected to be cushioned by higher revenues despite the increased tax burden and escalating expenses. For fiscal 2019, Nike expects the SG&A expenses to grow at a low-double-digit percentage rate. Nike expects its tax rate to be 16%–18%. The company hasn’t provided the EPS outlook.

Peers’ EPS projections

Analysts expect Under Armour’s adjusted EPS to rise 15.1% YoY to $0.22 in 2018. For 2019, Under Armour’s EPS is expected to increase 50.0% YoY to $0.33.

In fiscal 2018, analysts expect Columbia Sportswear’s adjusted EPS to increase 21.5% to $3.62. For fiscal 2019, Columbia Sportswear’s EPS could increase 12.4% to $4.07

For 2018, analysts expect that Skechers’ adjusted EPS could increase 3.4% to $1.84. For 2019, Skechers’ EPS is forecast to increase 8.2% to $1.99.

For Lululemon Athletica in fiscal 2018, analysts expect the EPS to increase 43.2% to $3.71. For fiscal 2019, the EPS is expected to increase 17.5% to $4.36.

Dividend yield

Nike remains committed to paying dividends to its stockholders. The company increased its dividend 10.0% to $0.22 in December. The annualized dividend is $0.88.

Nike’s dividend yield was 1.2% based on its closing price of $76.09 on January 14. Columbia Sportswear’s dividend yield was the same on January 14. Under Armour, Skechers, and Lululemon Athletica don’t pay dividends.