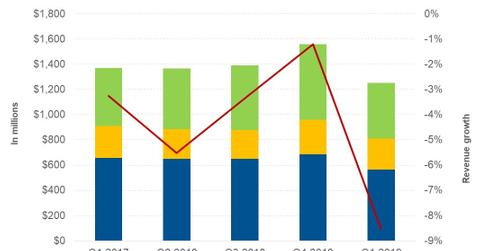

Why Yum! Brands’ Revenue Fell in the First Quarter

Yum! Brands reported revenue of $1.25 billion in the first quarter of 2019, which represented a fall of 8.5% from $1.56 billion in the first quarter of 2018.

May 2 2019, Published 3:33 p.m. ET

First-quarter revenue

Yum! Brands (YUM) reported revenue of $1.25 billion in the first quarter of 2019, which represented a fall of 8.5% from $1.56 billion in the first quarter of 2018. Due to refranchising, the overall unit count of its company-owned restaurants fell by 488 units, which led to a fall in its revenue. However, the company’s SSSG (same-store sales growth) of 4.0% and its net addition of 3,622 franchised restaurants offset some of the fall.

Let’s look at the performances of Yum! Brands’ three brands: KFC, Pizza Hut, and Taco Bell.

KFC

In the first quarter, KFC posted revenue of $566 million, a fall of 14.0% from $658 million in the first quarter of 2018. In the last four quarters, the unit count of KFC’s company-owned restaurants fell by 298, leading to a fall in the brand’s revenue. However, its SSSG of 5.0% and its net addition of 1,540 franchised restaurants offset some of the declines in its revenue in the period.

Pizza Hut

During the quarter, Pizza Hut’s revenue fell 3.2% to $243 million due to refranchising. In the last four quarters, the unit count of Pizza Hut’s company-owned restaurants fell by 58, leading to a fall in its revenue. However, the net addition of 1,728 franchised restaurants offset some of the fall in the brand’s revenue. The brand’s SSSG was flat in the quarter.

Taco Bell

Taco Bell’s revenue fell 3.7% to $445 million in the first quarter. Due to refranchising, the unit count of Taco Bell’s company-owned restaurants fell by 132, leading to a fall in its revenue. However, its net addition of 354 franchised restaurants and its SSSG of 4.0% offset some of the fall.