What’s Unique about Micron’s Stock Buyback Program?

Micron, a pure-play memory chipmaker, has one of the semiconductor industry’s most cyclical stocks.

Nov. 20 2020, Updated 2:13 p.m. ET

Micron’s stock buyback program

Previously, we saw that Qualcomm (QCOM) and Broadcom (AVGO) undertook an accelerated buyback to compensate shareholders for their failed mergers. Whereas these buybacks were expected, Micron Technology’s (MU) was a surprise. Micron, a pure-play memory chipmaker, has one of the semiconductor industry’s most cyclical stocks. For a cyclical stock, profits and losses are compounded, destabilizing their cash flow. Therefore, cyclical companies do not have a capital return program in place.

However, Micron has achieved a cash flow windfall over the last two years, which the company has used to improve liquidity and reduce debt. At the end of first quarter of fiscal 2019, Micron had a net cash position of $3.1 billion, with $4.1 billion in debt and $7.2 billion in cash.

On the back of its strong balance sheet, the company announced a $10 billion stock buyback program in May. It undertook its first buyback, of $1.8 billion, in fiscal 2019’s first quarter (ended November 30).

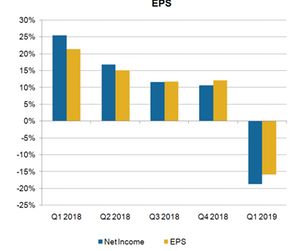

The effects of Micron’s buyback on its EPS

Micron’s non-GAAP net income fell 19% sequentially in the first quarter of fiscal 2019 amid weak demand and lower memory prices. The company mitigated the profit decline by 300 basis points through a stock buyback. Its non-GAAP EPS fell 16% sequentially to $2.97.

During Micron’s fiscal 2019 first-quarter earnings call, CFO David Zinsner stated that the company intends to use at least 50% of its free cash flow for buying back stock throughout 2019. The stock buyback could improve Micron’s EPS during cyclical downturn.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!