How Did Cannabis Stocks Perform Last Week?

Tilray (TLRY) stock fell as much as 5.5% last week, while Supreme Cannabis (SPRWF) fell ~4.4% in the week ending May 3.

Dec. 4 2020, Updated 10:52 a.m. ET

Cannabis stocks fell

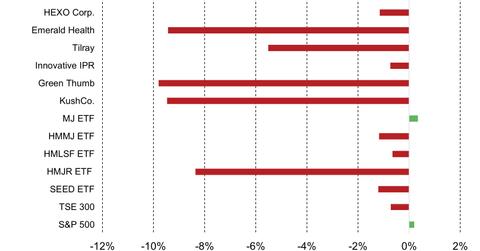

Last week, most of the stocks in the cannabis sector ended lower. The Horizons Marijuana Life Sciences ETF (HMMJ) fell ~1.2%, while the ETFMG Alternative Harvest ETF ended just slightly higher by 0.34% last week.

Biggest losses

In the above chart, Green Thumb Industries (GTBIF) was among the biggest losses with a weekly decline of 9.8%. Kushco Holdings (KSHB) fell 9.5%, while Emerald Health (EMHTF) fell ~9.4% last week.

Tilray (TLRY) stock fell as much as 5.5% last week, while Supreme Cannabis (SPRWF) fell ~4.4% in the week ending May 3. Last week, Jefferies upgraded Tilray’s rating to “hold” from “underperform.” Jefferies cut Tilray’s target price to $57 from $61 due to concerns about Tilray’s cost of purchasing from a third-party following the supply shortage.

HEXO (HEXO) has been one of the strongest performers in terms of price appreciation so far this year in the cannabis sector. HEXO ended last week 1.2% lower. Innovative Industrial Properties (IIPR), a cannabis sector REIT, ended last week 0.74% lower.

This week, Aurora Cannabis and Cronos Group are expected to announce their earnings. The earnings will likely set the tone for the next wave of momentum in the cannabis sector. To learn more, read Aurora Cannabis: What to Expect from Its Earnings and Cronos Group: What to Expect from Its Q1 Earnings.