Bank Loans or Floating Rate Notes: Which Should You Consider?

Investment-grade corporate floaters in particular not only benefit investors when short-term interest rates rise but also carry lower credit risk.

Dec. 27 2018, Updated 7:30 a.m. ET

VanEck

SOKOL: You mentioned bank loans, which is another floating rate asset class. There are other low-duration strategies that investors can allocate to, to reduce interest rate risk. Why consider floating rate notes over these other options?

RODILOSSO: Another really good question. You figure to reduce duration in your portfolio, you can either hold cash, or short-term bonds – very short-term bonds – or, as we were talking about just a minute ago, you could hold something like levered loans, or bank loan funds. Versus cash, FRNs do provide a healthy yield advantage: I mentioned earlier, currently, FLTR, for instance, 70-75 basis points above LIBOR, which is not insignificant particularly when you look at your money market options. Which are below LIBOR. Short-term fixed-rate bonds are an option, with, right now, a small yield pick-up over, say, FRNs. But they still do have duration. Most of those types of products or funds are in a zero to 5-year category. An average duration is closer to 2.5, I believe, in those products.

So you do still have a level of interest rate risk, longer spread risk actually. A little higher sensitivity also to movements in credit spreads in those fixed-rate funds versus FRNs. So for marginal yield pickups. So the question is the risk-reward there. You’re better off just getting the near-zero interest rate duration. Then as I mentioned, bank loans. That’s just a question of a credit exposure decision. That’s one reason why people may favor investment grade FRNs rather than going farther out the credit curve for definitely a yield pickup. But also, aside from it, the sort of credit aspect, there is the structural aspect. And for many investors, bank loans are attractive. Historically, they’ve held up well in terms of default rates and recovery rates, but they’re still sub-investment grade and they’re still loans, particularly in, say, ETF structures having instruments that have longer than the normal T+2 settlement cycle.

They settle by assignment, usually at least a seven day period. That’s one of the areas where if the market does grow concerned about the ETF structure, and how it holds up, the vast majority of ETFs have certainly shown to be able to withstand all types of market situations. But there is a settlement/structural mismatch there. Those funds have managed well through periods of volatility to date. So there’s a credit question and a structural question on the bank loan side versus FRNs.

Market Realist

How are FRNs better than bank loans?

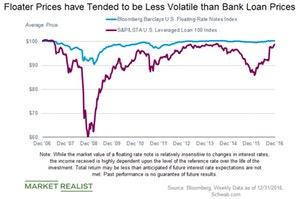

In the previous part, we discussed the advantages of floating rate notes during periods of rising rates. Investment-grade corporate floaters in particular not only benefit investors when short-term interest rates rise but also carry lower credit risk, thus lowering the risk of default. The floating rate notes benchmark rate is the three-month LIBOR rate, which is highly correlated to the Fed funds rate, thus increasing the coupon payments when the Fed hikes rates. FRNs also carry lower duration, which is nothing but a measure of interest rate sensitivity.

Bank loans, on the other hand, are riskier since they have more downside risk and fewer chances of price appreciation. Bank loans are the type of corporate debt held by large institutions, which have lower credit ratings, thus increasing the chances of default. Therefore, investors should carefully measure the risk and reward of each before making any investment decisions.

In the last part, we’ll discuss how investors can include the VanEck Vectors Investment Grade Floating Rate ETF (FLTR) in their portfolio.