VanEck Vectors Investment Grade Floating Rate ETF

Latest VanEck Vectors Investment Grade Floating Rate ETF News and Updates

Industrials March manufacturing releases are critical in assessing a recovery

The Purchasing Managers Manufacturing Index (or PMI) is based on a monthly survey of selected companies that provide an advanced indication of what’s really happening in the private-sector economy.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

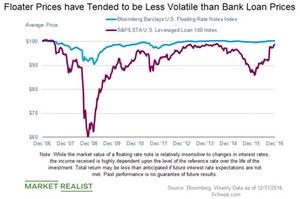

Bank Loans or Floating Rate Notes: Which Should You Consider?

Investment-grade corporate floaters in particular not only benefit investors when short-term interest rates rise but also carry lower credit risk.