A Closer Look at Facebook’s Profitability Ratio

Facebook’s (FB) TTM (trailing -12- months) gross margin stands at 84.26%, compared to the industry and sector averages of 40.63% and 43.56%, respectively.

Dec. 31 2018, Updated 3:20 p.m. ET

Profitability ratio

Facebook’s (FB) TTM (trailing -12- months) gross margin stands at 84.26%, compared to the industry and sector averages of 40.63% and 43.56%, respectively. Facebook’s five-year gross margin is 84.86%.

The company’s TTM operating margin is 47.10%, whereas the industry and sector averages are 23.57% and 22.41%, respectively.

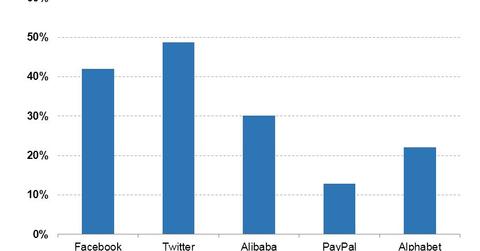

Facebook’s TTM net profit margin is 41.96%, compared to industry and sector averages of 25% and 17.48%, respectively. Peers Twitter (TWTR), Alibaba (BABA), PayPal (PYPL), and Alphabet (GOOGL) have TTM net profit margins of 48.66%, 30.10%, 12.82%, and 22.02%, respectively.

The TTM EBITDA margin for Facebook stands at 54.70% while the five-year average is 52.76%, compared to the industry average of 31.09%.

The pre-tax margin for the trailing 12 months comes is at 47.89%, compared to an industry average of 31.74%. The five-year average margin stands at 44.08%, compared to the industry average of 28.98%.

Facebook’s effective tax rate for the trailing 12 months totals 12.39%, compared to the industry average of 23.56%. The five-year average, on the other hand, is 22.18%.

Growth rates

In its most recent quarter, Facebook’s sales rose 32.91% YoY (year-over-year) while the industry’s grew 10.78% YoY and the sector’s grew 7.68% YoY. Facebook’s sales have grown 51.53% over the past five years, and the industry and sector have grown 20.62% and 5.49%, respectively.

Facebook’s EPS grew 10.75% YoY in the most recent quarter, and its five-year EPS growth rate is 234.22%.

Efficiency

Facebook’s TTM revenue-to-employee ratio is 2,067,158x, and the industry and sector averages are 24,643,983x and 6,369,131x, respectively. Meanwhile, its TTM net-income-to-employee ratio is 867,277x, and the industry and sector averages are 4,569,150x and 733,154x. Facebook’s TTM asset turnover ratio is 0.61x.

Management’s effectiveness

Facebook’s TTM ROA (return-on-assets) ratio is 25.40x while the industry and sector averages are 11.68x and 13.74x, respectively. Its five-year ROA ratio is 16.46x, and the industry and sector averages are 11.92x and 10.36x.

Facebook’s TTM return-on-investment ratio is 26.77x, and its five-year average is 17.22x. Its TTM return-on-equity ratio is 18.41x.