Why United Parcel Service’s Operating Margin Declined in Q3 2018

UPS’s operating profit declined 4.7% to $1.7 billion in the third quarter from $1.8 billion in the third quarter of 2017.

Oct. 30 2018, Updated 10:30 a.m. ET

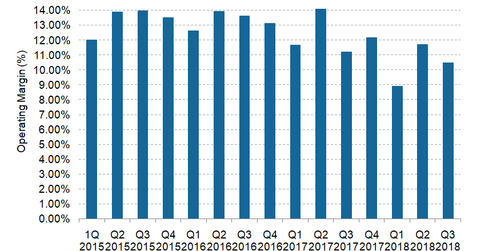

UPS’s Q3 operating margins

In this part, we’ll examine United Parcel Service’s (UPS) operating margins in the third quarter. The company’s operating expenses rose 9.4% in the third quarter to $15.7 billion from $14.3 billion in the third quarter of 2017. Its increase in operating expenses exceeded its total revenue growth of 7.9% in the quarter.

UPS’s operating profit declined 4.7% to $1.7 billion in the third quarter from $1.8 billion in the third quarter of 2017. Its adjusted operating margins contracted 70 basis points to 10.5% from 11.2%.

Segmental Q3 operating margins

The US Domestic Package segment’s reported operating income totaled $949.0 million, which equals $988.0 million on an adjusted basis in the third quarter. This metric was $1.0 billion in the third quarter of 2017. Its third-quarter adjusted margin stood at 9.5% compared with 10.5% in the third quarter of 2017. The Domestic segment’s third-quarter operating income was reduced by planned increases in pension expense and the cost of network improvements.

The International Package segment’s third-quarter operating income declined 11.6% YoY on a reported basis and 5.0% YoY on an adjusted basis. The segment’s adjusted operating margin was down 1.4% to 16.6% in the third quarter compared to 18.0% in the third quarter of 2017. The International vertical’s operating income decline was due to headwinds from currency and fuel as well as slowing economic activity resulting from trade policy changes.

The Supply Chain and Freight segment’s reported operating income stood at $242.0 million in the third quarter compared with $195.0 million in the third quarter of 2017. The third quarter’s adjusted operating profit of $260.0 million was up 33.3% YoY. Its adjusted operating margin was up 120 basis points to 7.4% in the third quarter from 6.2% in the third quarter of 2017.

Management’s outlook

United Parcel Service’s (UPS) transformation initiatives are expected to impact its operating costs in the coming quarter. The company targets a long-term operating margin of 15.0%.

The International Package segment’s operating income is expected to improve in the coming quarters. However, UPS expects a $35.0 million–$45.0 million negative impact on the International segment’s operating margin in the fourth quarter.

In the Supply Chain and Freight segment, demand from the retail, manufacturing, and healthcare sectors could boost the Logistics and Distribution business unit’s operating profit and margin growth. UPS’s investment in technology and pricing initiatives could boost its 2018 operating margin.

Peers’ Q3 operating margins

Among the major road transportation (IYJ) companies, Old Dominion Freight Line (ODFL) reported an improvement of 280 basis points in its third-quarter operating margin to 21.6% from 18.8% in the third quarter of 2017.

Landstar System (LSTR) reported a 7.5% expansion in its third-quarter operating margin to 50.8% from 43.3% in the third quarter of 2017. Saia (SAIA) and XPO Logistics (XPO), major LTL (less-than-truckload) service providers, are set to release their third-quarter earnings on October 31 and November 1, respectively.

In the final part of this series, we’ll look at analysts’ recommendations for UPS and peers.