What’s Backing the Uptrend in Hormel Foods Stock?

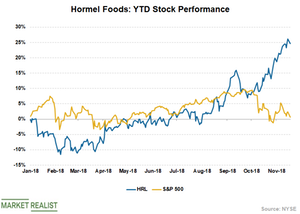

Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year.

Nov. 20 2018, Updated 5:55 p.m. ET

HRL stock outperforms so far this year

Besides McCormick (MKC) and Church & Dwight (CHD), Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year. HRL is up 24.6% YTD (year-to-date) as of November 19 and has performed better than most of its peers.

In comparison, the stocks of Tyson Foods (TSN), the Campbell Soup Company (CPB) and Conagra Brands (CAG) have marked double-digit falls.

The company’s recent acquisitions, including Ceratti, Fontanini, and Columbus Craft Meats, are driving its top line growth. Meanwhile, strength in its branded portfolio, its focus on innovation, and its brand marketing investments have further supported its top line growth. Healthy sales growth and a fall in the effective tax rate are driving the company’s bottom line, which has grown at a double-digit rate in the past two quarters.

Outlook

Hormel Foods’ top line is expected to continue to benefit from the improved volumes in its value-added businesses. Its recent acquisitions are also expected to contribute meaningfully to its top line growth. However, retaliatory tariffs could adversely affect pork and turkey pricing and, in turn, HRL’s organic sales growth. Higher freight costs and increased advertising investments could also continue to hurt its margins. However, its lower effective tax rate should cushion its bottom line growth.

The majority of Wall Street analysts maintain “holds” on Hormel Foods stock. Volatility owing to tariffs and the company’s higher valuation in comparison to its peers’ are keeping analysts on the sidelines. Hormel Foods stock is trading at a forward PE multiple of 25.1x, higher than the peer average.