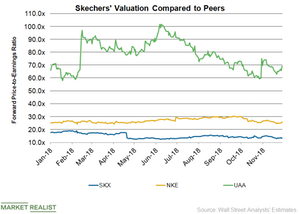

Skechers’ Valuation Compared to Its Peers

As of November 28, Skechers (SKX) was trading at a 12-month forward PE multiple of 13.6x.

Nov. 30 2018, Updated 10:31 a.m. ET

Forward valuation multiple

As of November 28, Skechers (SKX) was trading at a 12-month forward PE multiple of 13.6x. Skechers’ valuation multiple has declined 1.4% since the announcement of its third-quarter results in October. Skechers missed analysts’ sales expectation but exceeded the earnings estimates in the third quarter.

Nike (NKE) and Under Armour (UAA) were trading at 12-month forward PE multiples of 25.9x and 69.4x, respectively, as of November 28. The S&P 500 was trading at 12-month forward PE multiple of 16.3x.

Skechers is seeking growth opportunities in international markets. In the third quarter, Skechers’ international business, including wholesale and retail, accounted for 55.5% of the overall sales. China is one of the main focus areas for the company’s business expansion plans overseas. However, Skechers is incurring increased expenses to support the strong growth in China. Investments in the company’s international expansion and other growth initiatives are having a negative impact on the bottom line.

Skechers e-commerce business is also growing and strengthening the company’s direct-to-consumer business. The company’s domestic e-commerce sales grew 15% in the third quarter. Aside from the US, Skechers also has e-commerce sites in Chile, Germany, the United Kingdom, Spain, and Canada.

Analysts’ expectations

Analysts expect Skechers’ sales to grow 12.0% to $4.7 billion and the adjusted EPS to rise 3.9% to $1.85 in 2018. Currently, analysts expect Skechers’ sales and adjusted EPS to increase 9.4% and 8.1%, respectively, in 2019.

Nike’s adjusted EPS is expected to grow 10.9% in fiscal 2019, which ends on May 31, 2019. Nike’s adjusted EPS is expected to rise 18.5% in fiscal 2020. Under Armour is expected to report a 16% rise in its 2018 adjusted EPS and 54.6% growth in 2019.