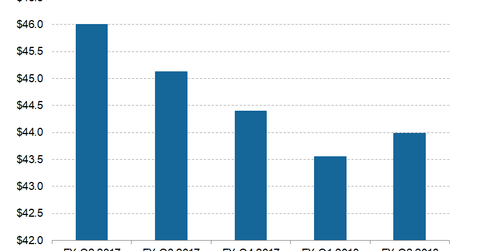

Analyzing Sprint’s Postpaid Average Revenue per User

In the second quarter of fiscal 2018 (ended in September), Sprint’s postpaid average revenue per user fell ~4.4% year-over-year to $43.99.

Nov. 26 2018, Updated 9:01 a.m. ET

Sprint’s postpaid average revenue per user

Let’s now look at Sprint’s (S) postpaid ARPU (average revenue per user), or its unit service revenue. In the second quarter of fiscal 2018 (ended in September), Sprint’s postpaid ARPU fell ~4.4% YoY (year-over-year) to $43.99, and adjusting for the company’s new revenue recognition accounting standards, it fell ~2.2% YoY to $44.99. This reduction was mainly due to promotions.

According to the company, about 83% of its postpaid phone customers are now on unsubsidized service plans, compared with 78% in the second quarter of fiscal 2017. As the penetration of unsubsidized plans increases, the wireless carrier’s postpaid ARPU decline could slow.

Sprint’s postpaid phone average billings per user

On the positive side, Sprint’s postpaid phone ABPU (average billings per user) continued to improve YoY in the second quarter of fiscal 2018. The metric rose ~0.2% YoY to $69.10, driven by higher equipment rentals. Its ABPU includes service revenue and installment payments made by postpaid subscribers. These installment billings are categorized as equipment revenue.

Sprint was the fourth-largest player in the US wireless market by customer count as of September 30, exiting the quarter with 53.5 million wireless subscribers. Verizon (VZ), AT&T (T), and T-Mobile (TMUS) closed the quarter with 154.0 million, 150.3 million, and 77.2 million wireless subscribers, respectively.