What to Expect for Harley-Davidson’s Q1 Profit Margin

In the fourth quarter, Harley-Davidson’s (HOG) gross profit from motorcycles and related products fell ~17.5% YoY (year-over-year) to $564 million from $320 million, reducing the segment’s gross margin YoY to 27.6% from 30.6%.

April 16 2019, Published 2:08 p.m. ET

Harley-Davidson’s profitability

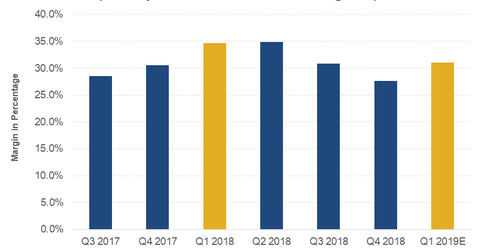

In the fourth quarter, Harley-Davidson’s (HOG) gross profit from motorcycles and related products fell ~17.5% YoY (year-over-year) to $564 million from $320 million, reducing the segment’s gross margin YoY to 27.6% from 30.6%.

Profitability last year

Last year, Harley-Davidson’s gross profit margin narrowed slightly YoY, to 32.5% from 33.4%, presenting another concern for the company. Harley’s international profit margin is much weaker than its US margin, due to higher demand for its low-priced motorcycles in the international market.

Analysts’ Q1 profit margin estimates

Analysts expect Harley-Davidson’s negative profitability (IYK) trend to continue in the first quarter. They expect the company’s gross margin to contract YoY, to 31.0% from 34.7%.

Harley-Davidson has increased efforts to expand its international presence in the last few quarters due to ongoing challenges in its home market. As a result, shipments of its low-priced motorcycle models have risen because their demand is high outside North America, affecting Harley-Davidson’s profitability.