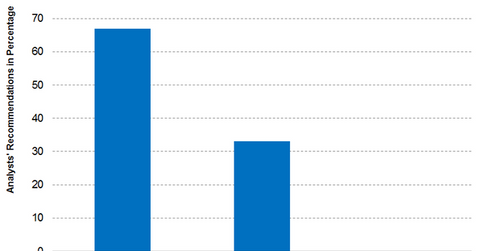

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

Jan. 21 2019, Updated 7:31 a.m. ET

Analysts’ recommendations

The number of analysts following Stanley Black & Decker (SWK) has remained consistent in the past six months. Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.” None of the analysts have a “sell” recommendation for Stanley Black & Decker.

Analysts expect Stanley Black & Decker’s target price to be $147.13, which implies a return potential of 10.9% over the closing price of $132.65 as of January 17. In the past three months, Stanley Black & Decker’s target price has fallen significantly from $172.4 to the current target price. Stanley Black & Decker’s increased raw material costs have been a worrying sign. However, the announcement of $250 million cost restructuring program could be positive for the company. As a result, many of the analysts have recommended to “buy” Stanley Black & Decker.

Brokerage recommendations

- Credit Suisse (CS) has increased its target price for Stanley Black & Decker to $155 from $135, which implies a 16.9% return potential based on its closing price on January 17.

- UBS (UBS) has cut the target price for Stanley Black & Decker to $150, which implies a 13% return potential based on its closing price on January 17.

- Morgan Stanley (MS) has recommended a target price of $140 for Stanley Black & Decker, which implies a 5.6% return over the closing price as of January 17.

Investors could hold Stanley Black & Decker indirectly through the Guggenheim S&P 500 Equal Weight Industrials ETF (RGI), which invests 1.5% of its portfolio in Stanley Black & Decker as of January 17.