Key Updates Markets Are Waiting for in U.S. Steel’s 1Q17 Call

In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

April 19 2017, Updated 9:07 a.m. ET

U.S. Steel’s 1Q17 call

Previously, we looked at analysts’ estimates for U.S. Steel Corporation’s (X) 1Q17 earnings. In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

Industry outlook

For steel companies such as ArcelorMittal (MT), AK Steel (AKS), and Nucor (NUE), the industry outlook is as important—if not more important—than their positions in the industry.

During its 1Q17 earnings call, the market will look for U.S. Steel’s management’s commentary on steel’s price outlook. Notably, we’ve seen a steep fall in seaborne iron ore and Chinese steel prices over the last couple of weeks. So far, these factors haven’t had a big impact on US steel prices, but we could see some repercussions if Chinese steel prices trend further downward.

Energy markets

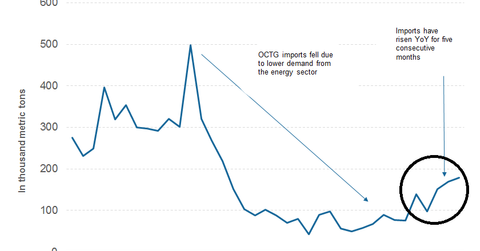

Along with the industry outlook, it’ll be interesting to hear about U.S. Steel’s management’s views on the energy market. U.S. Steel’s Tubular segment produces OCTG (oil country tubular goods) used in the energy industry. OCTG imports rose ~85% year-over-year (or YoY) in February 2017, marking the fifth consecutive month in which we’ve seen a steep rise in OCTG imports.

While the United States has recently raised duties on its imports of OCTG products from South Korea, the markets fear that even this won’t be enough to fend off imports. The markets (MDY) (MID-INDEX) will also be looking for updates from U.S. Steel on the recent chemical discharge at its Midwest plant.

U.S. Steel’s 2017 guidance could be another point of focus during its 1Q17 earnings call. We’ll discuss this more in the next article.